Summary

The concept of convex compactness, weaker than the classical notion of compactness, is introduced and discussed. It is shown that a large class of convex subsets of topological vector spaces shares this property and that is can be used in lieu of compactness in a variety of cases. Specifically, we establish convex compactness for certain familiar classes of subsets of the set of positive random variables under the topology induced by convergence in probability. Two applications in infinite-dimensional optimization - attainment of infima and a version of the Minimax theorem - are given. Moreover, a new fixed-point theorem of the Knaster-Kuratowski-Mazurkiewicz-type is derived and used to prove a general version of the Walrasian excess-demand theorem.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

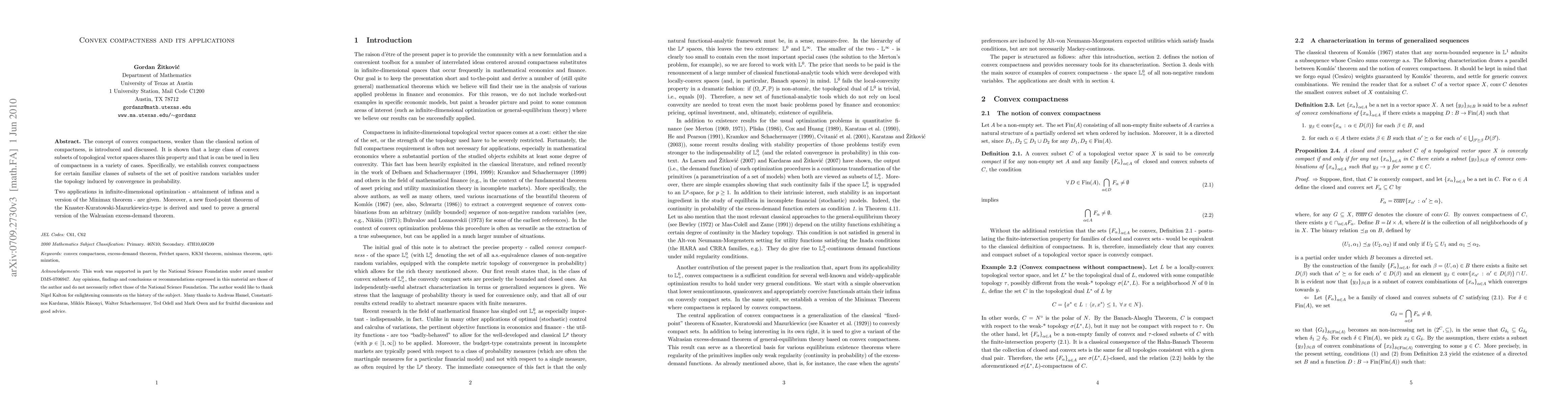

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)