Summary

In incomplete financial markets not every contingent claim can be replicated by a self-financing strategy. The risk of the resulting shortfall can be measured by convex risk measures, recently introduced by F\"ollmer, Schied (2002). The dynamic optimization problem of finding a self-financing strategy that minimizes the convex risk of the shortfall can be split into a static optimization problem and a representation problem. It follows that the optimal strategy consists in superhedging the modified claim $\widetilde{\varphi}H$, where $H$ is the payoff of the claim and $\widetilde{\varphi}$ is the solution of the static optimization problem, the optimal randomized test. In this paper, we will deduce necessary and sufficient optimality conditions for the static problem using convex duality methods. The solution of the static optimization problem turns out to be a randomized test with a typical $0$-$1$-structure.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

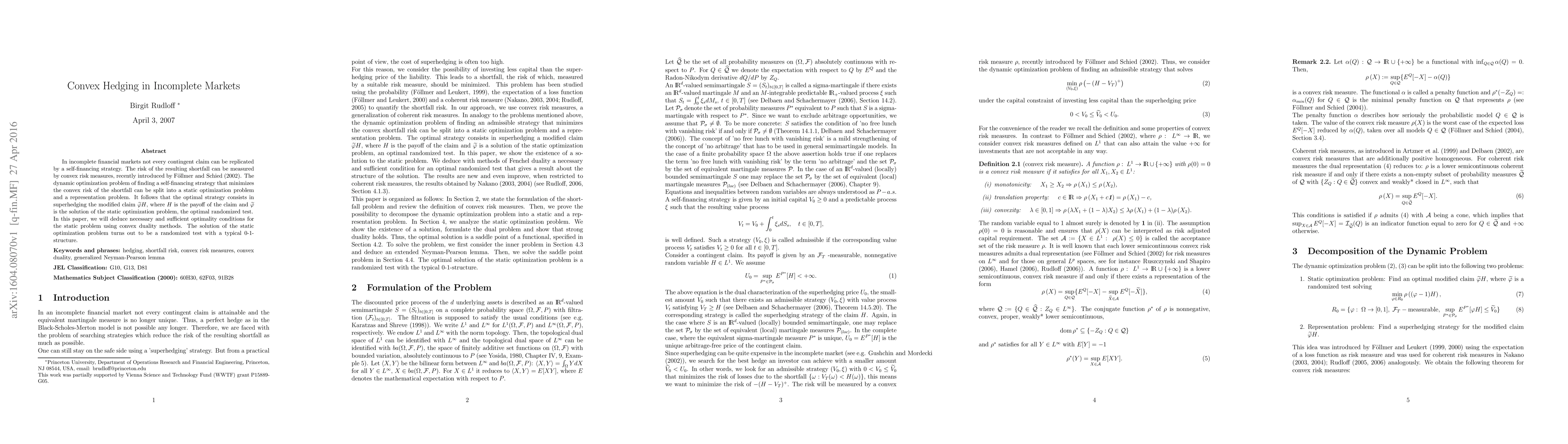

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal positioning in derivative securities in incomplete markets

Tim Leung, Matthew Lorig, Yoshihiro Shirai

| Title | Authors | Year | Actions |

|---|

Comments (0)