Summary

We consider a collection of derivatives that depend on the price of an underlying asset at expiration or maturity. The absence of arbitrage is equivalent to the existence of a risk-neutral probability distribution on the price; in particular, any risk neutral distribution can be interpreted as a certificate establishing that no arbitrage exists. We are interested in the case when there are multiple risk-neutral probabilities. We describe a number of convex optimization problems over the convex set of risk neutral price probabilities. These include computation of bounds on the cumulative distribution, VaR, CVaR, and other quantities, over the set of risk-neutral probabilities. After discretizing the underlying price, these problems become finite dimensional convex or quasiconvex optimization problems, and therefore are tractable. We illustrate our approach using real options and futures pricing data for the S&P 500 index and Bitcoin.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

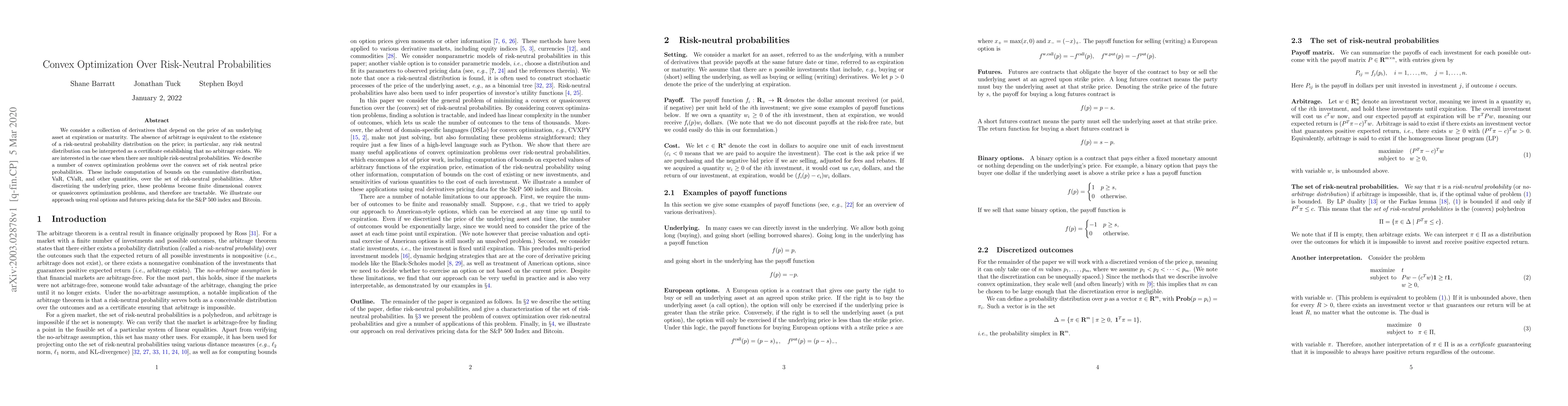

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal Methods for Convex Risk Averse Distributed Optimization

Zhe Zhang, Guanghui Lan

No citations found for this paper.

Comments (0)