Authors

Summary

We establish results on the conditional and standard convex order, as well as the increasing convex order, for two processes $ X = (X_t)_{t \in [0, T]} $ and $ Y = (Y_t)_{t \in [0, T]}$, defined by the following McKean-Vlasov equations with common Brownian noise $B^0 = (B_t^0)_{t \in [0, T]}$: \begin{align} dX_t &= b(t, X_t, \mathcal{L}^1(X_t))dt + \sigma(t, X_t, \mathcal{L}^1(X_t))dB_t + \sigma^0(t, \mathcal{L}^1(X_t))dB^0_t, \\ dY_t &= \beta(t, Y_t, \mathcal{L}^1(Y_t))dt + \theta(t, Y_t, \mathcal{L}^1(Y_t))dB_t + \theta^0(t, \mathcal{L}^1(Y_t))dB^0_t, \end{align} where $\mathcal{L}^1(X_t)$ (respectively $\mathcal{L}^1(Y_t)$) denotes a version of the conditional distribution of $X_t$ (resp. $Y_t$) given $B^0$. These results extend those established for standard McKean-Vlasov equations in [Liu and Pag\`es, Ann. App. Prob. 2023] and [Liu and Pag\`es, Bernoulli 2022]. Under suitable conditions, for a (non-decreasing) convex functional $F$ on the path space with polynomial growth, we show $\mathbb{E}[F(X) \mid B^0] \leq \mathbb{E}[F(Y) \mid B^0]$ almost surely. Moreover, for a (non-decreasing) convex functional $G$ defined on the product space of paths and their marginal distributions, we establish \[ \mathbb{E} \Big[\,G\big(X, (\mathcal{L}^1(X_t))_{t\in[0, T]}\big)\,\Big| \, B^0\,\Big]\leq \mathbb{E} \Big[\,G\big(Y, (\mathcal{L}^1(Y_t))_{t\in[0, T]}\big)\,\Big| \, B^0\,\Big] \quad \text{almost surely}. \] Similar convex order results are also established for the corresponding particle system. We explore applications of these results to stochastic control problem - deducing in particular an associated comparison principle for Hamilton-Jacobi-Bellman equations with different coefficients - and to the interbank systemic risk model introduced by in [Carmona, Fouque and Sun, Comm. in Math. Sci. 2015].

AI Key Findings

Generated Jun 09, 2025

Methodology

The research employs a stochastic approach using McKean-Vlasov equations with common noise, leveraging Euler schemes for discretization and analysis.

Key Results

- Establishes conditional and standard convex orders for McKean-Vlasov processes with common noise.

- Demonstrates that for a non-decreasing convex functional F, \(\mathbb{E}[F(X) \mid B^0

Significance

This work extends previous findings on McKean-Vlasov equations to include common noise, offering a more comprehensive framework for analyzing stochastic systems with correlated noise components, which is crucial for modeling real-world phenomena in finance and risk management.

Technical Contribution

The paper introduces a rigorous framework for analyzing convex orders in the presence of common noise in McKean-Vlasov processes, extending previous work to include more realistic noise structures.

Novelty

The novelty lies in the extension of convex order results to McKean-Vlasov equations with common noise, providing a more nuanced understanding of stochastic ordering in systems with correlated noise components.

Limitations

- Theoretical results are primarily established under specific conditions on the drift and diffusion coefficients.

- Practical implementation might require careful consideration of the assumptions to ensure applicability in real-world scenarios.

Future Work

- Investigate the implications of these results in more complex financial models, such as those involving jump processes or stochastic volatility.

- Explore extensions to higher-dimensional systems and their applications in multi-asset models.

Paper Details

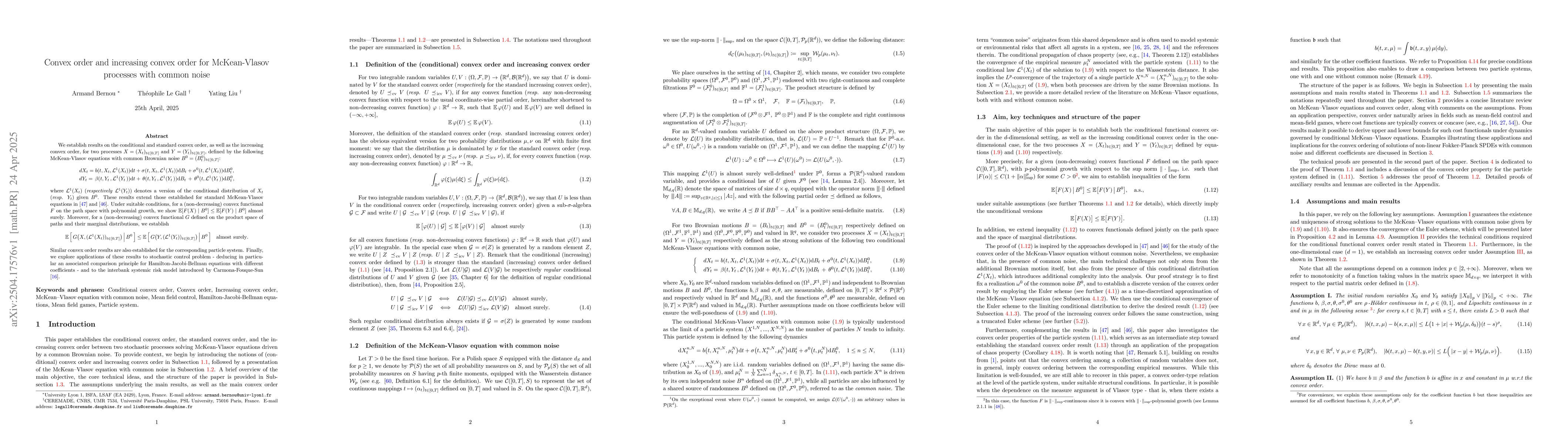

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)