Summary

In this paper we investigate the applicability of a recently introduced primal-dual splitting method in the context of solving portfolio optimization problems which assume the minimization of risk measures associated to different convex utility functions. We show that, due to the splitting characteristic of the used primal-dual method, the main effort in implementing it constitutes in the calculation of the proximal points of the utility functions, which assume explicit expressions in a number of cases. When quantifying risk via the meanwhile classical Conditional Value-at-Risk, an alternative approach relying on the use of its dual representation is presented as well. The theoretical results are finally illustrated via some numerical experiments on real and synthetic data sets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

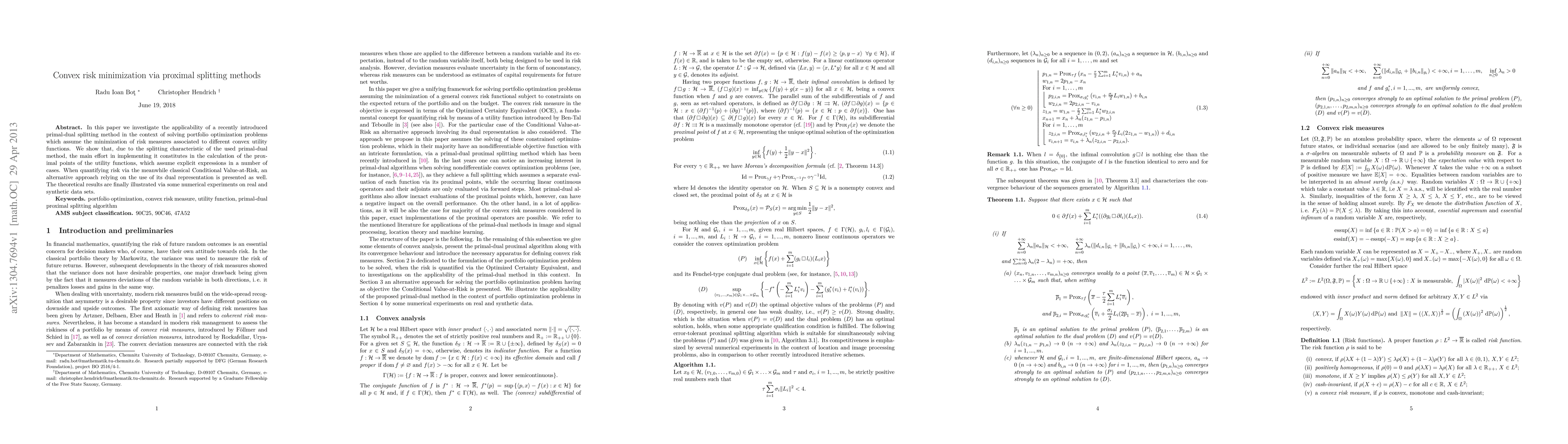

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)