Summary

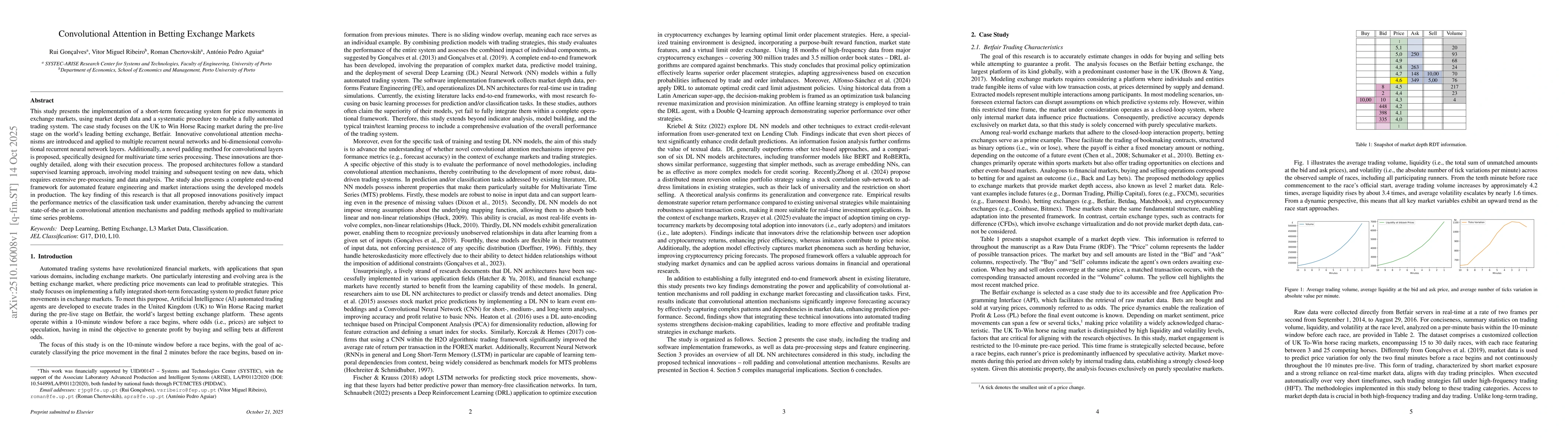

This study presents the implementation of a short-term forecasting system for price movements in exchange markets, using market depth data and a systematic procedure to enable a fully automated trading system. The case study focuses on the UK to Win Horse Racing market during the pre-live stage on the world's leading betting exchange, Betfair. Innovative convolutional attention mechanisms are introduced and applied to multiple recurrent neural networks and bi-dimensional convolutional recurrent neural network layers. Additionally, a novel padding method for convolutional layers is proposed, specifically designed for multivariate time series processing. These innovations are thoroughly detailed, along with their execution process. The proposed architectures follow a standard supervised learning approach, involving model training and subsequent testing on new data, which requires extensive pre-processing and data analysis. The study also presents a complete end-to-end framework for automated feature engineering and market interactions using the developed models in production. The key finding of this research is that all proposed innovations positively impact the performance metrics of the classification task under examination, thereby advancing the current state-of-the-art in convolutional attention mechanisms and padding methods applied to multivariate time series problems.

AI Key Findings

Generated Oct 30, 2025

Methodology

The research employs a deep learning approach combining LSTM networks with multi-head attention mechanisms and Conv1D processing to forecast short-term price movements in the Betfair UK to Win Horse Racing market. It involves systematic feature engineering, model training, and production testing using a 30-day final test dataset.

Key Results

- LSTM-based models with multi-head attention achieved the highest accuracy at 30.92%

- The inclusion of roll padding improved accuracy for both CNN and WaveNet models

- The model consistently predicted more trades with expected positive PL than negative

Significance

This research demonstrates the feasibility of using advanced DL techniques for profitable trading in competitive markets, offering insights into effective model design and implementation for real-world trading strategies.

Technical Contribution

Development of a DL architecture integrating LSTM with multi-head attention and Conv1D processing for time-series prediction in financial markets

Novelty

Combining multi-head convolutional attention with roll padding in CNN-based models represents a novel approach to enhance pattern recognition in market data

Limitations

- The relatively small sample size may affect model generalization

- The study focuses on a single market, limiting broader applicability

Future Work

- Exploring optimal stake policies for maximizing absolute PL

- Investigating adaptive model refinement techniques for changing market conditions

Paper Details

PDF Preview

Similar Papers

Found 5 papersOnline Learning in Betting Markets: Profit versus Prediction

Lexing Xie, Haiqing Zhu, Alexander Soen et al.

Are Betting Markets Better than Polling in Predicting Political Elections?

Laurie E. Cutting, Hiba Baroud, Sarah S. Hughes-Berheim et al.

Comments (0)