Authors

Summary

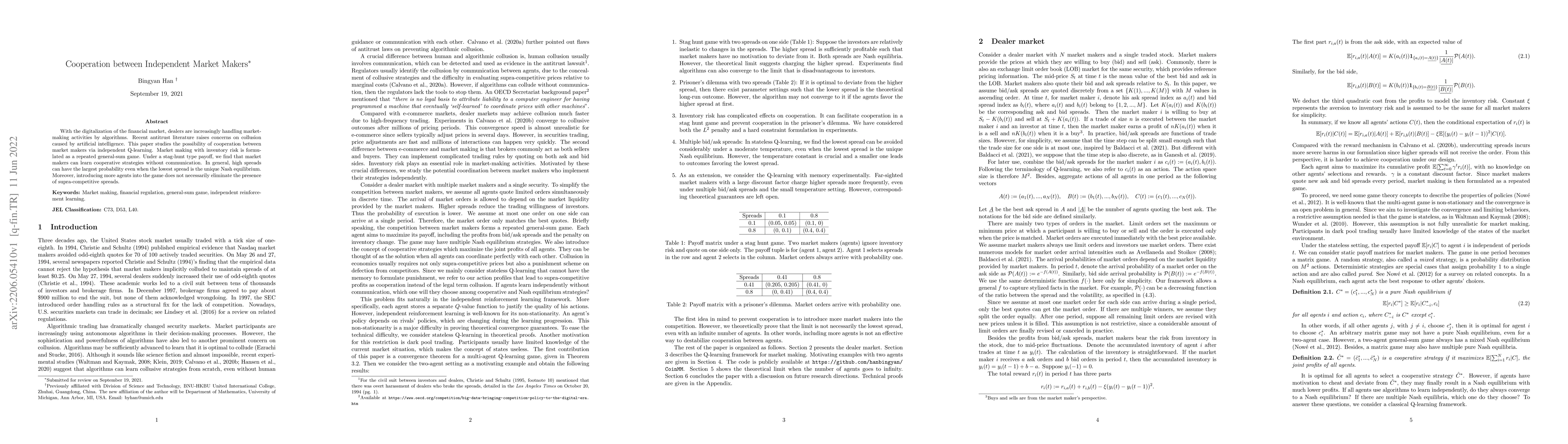

With the digitalization of the financial market, dealers are increasingly handling market-making activities by algorithms. Recent antitrust literature raises concerns on collusion caused by artificial intelligence. This paper studies the possibility of cooperation between market makers via independent Q-learning. Market making with inventory risk is formulated as a repeated general-sum game. Under a stag-hunt type payoff, we find that market makers can learn cooperative strategies without communication. In general, high spreads can have the largest probability even when the lowest spread is the unique Nash equilibrium. Moreover, introducing more agents into the game does not necessarily eliminate the presence of supra-competitive spreads.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAxioms for Constant Function Market Makers

Mateusz Kwaśnicki, Akaki Mamageishvili, Jan Christoph Schlegel

| Title | Authors | Year | Actions |

|---|

Comments (0)