Summary

The benefits of diversifying risks are difficult to estimate quantitatively because of the uncertainties in the dependence structure between the risks. Also, the modelling of multidimensional dependencies is a non-trivial task. This paper focuses on one such technique for portfolio aggregation, namely the aggregation of risks within trees, where dependencies are set at each step of the aggregation with the help of some copulas. We define rigorously this procedure and then study extensively the Gaussian Tree of quite arbitrary size and shape, where individual risks are normal, and where the Gaussian copula is used. We derive exact analytical results for the diversification benefit of the Gaussian tree as a function of its shape and of the dependency parameters. Such a "toy-model" of an aggregation tree enables one to understand the basic phenomena's at play while aggregating risks in this way. In particular, it is shown that, for a fixed number of individual risks, "thin" trees diversify better than "fat" trees. Related to this, it is shown that hierarchical trees have the natural tendency to lower the overall dependency with respect to the dependency parameter chosen at each step of the aggregation. We also show that these results hold in more general cases outside the gaussian world, and apply notably to more realistic portfolios (LogNormal trees). We believe that any insurer or reinsurer using such a tool should be aware of these systematic effects, and that this awareness should strongly call for designing trees that adequately fit the business. We finally address the issue of specifying the full joint distribution between the risks. We show that the hierarchical mechanism does not require nor specify the joint distribution, but that the latter can be determined exactly (in the Gaussian case) by adding conditional independence hypotheses between the risks and their sums.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

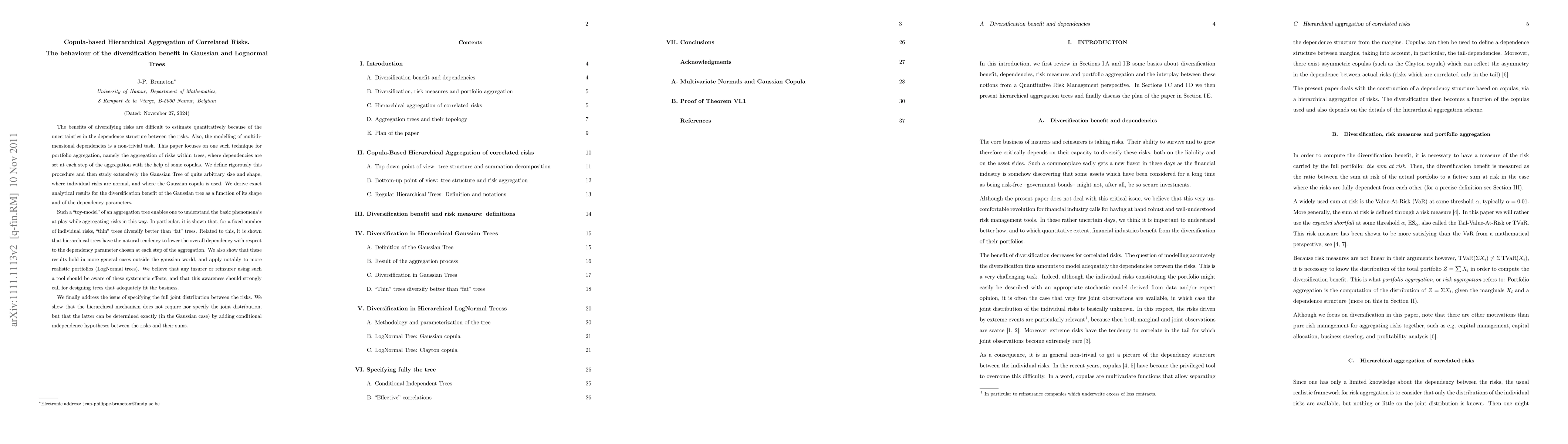

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)