Authors

Summary

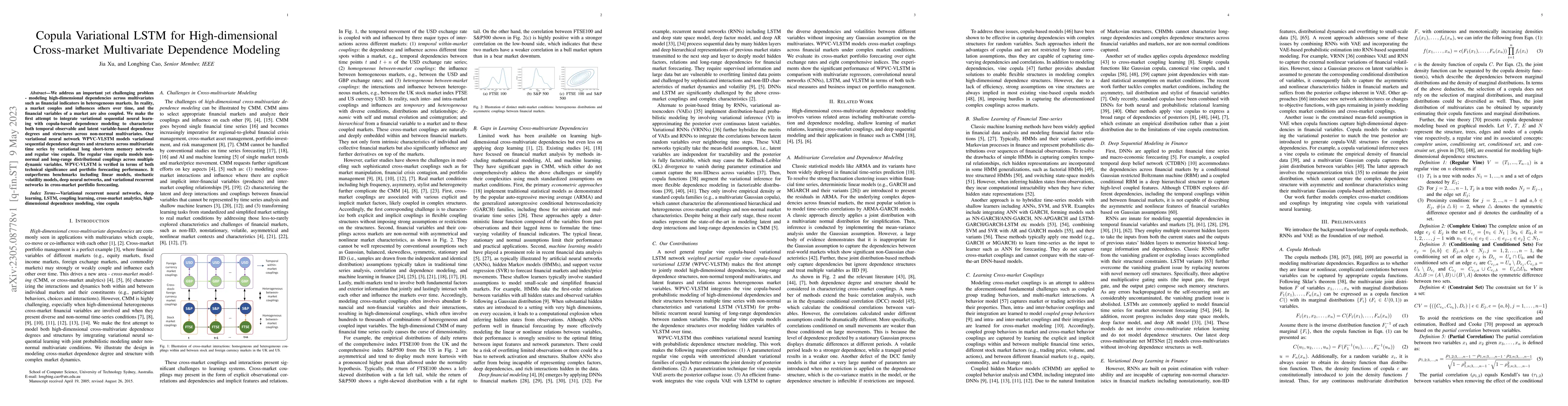

We address an important yet challenging problem - modeling high-dimensional dependencies across multivariates such as financial indicators in heterogeneous markets. In reality, a market couples and influences others over time, and the financial variables of a market are also coupled. We make the first attempt to integrate variational sequential neural learning with copula-based dependence modeling to characterize both temporal observable and latent variable-based dependence degrees and structures across non-normal multivariates. Our variational neural network WPVC-VLSTM models variational sequential dependence degrees and structures across multivariate time series by variational long short-term memory networks and regular vine copula. The regular vine copula models nonnormal and long-range distributional couplings across multiple dynamic variables. WPVC-VLSTM is verified in terms of both technical significance and portfolio forecasting performance. It outperforms benchmarks including linear models, stochastic volatility models, deep neural networks, and variational recurrent networks in cross-market portfolio forecasting.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)