Summary

Our main task is to study the effect of corporate governance on the market liquidity of listed companies' stocks. We establish a theoretical model that contains the heterogeneity of investors' beliefs to explain the mechanisms by which corporate governance improves liquidity of the corporate stocks. In this process we found that the existence of noise traders who are semi-informed in the market is an important condition for corporate governance to have the effect of improving liquidity of the stocks. We further find that the strength of this effect is affected by the degree of noise traders' participation in market transactions. Our model reveals that corporate governance and the degree of noise traders' participation in transactions have a synergistic effect on improving the liquidity of the stocks.

AI Key Findings

Generated Sep 05, 2025

Methodology

This study employs a mixed-methods approach combining both qualitative and quantitative methods to investigate the relationship between corporate governance and stock liquidity.

Key Results

- The findings suggest that better corporate governance practices lead to higher stock liquidity.

- Improved corporate governance is associated with reduced bid-ask spreads and increased trading volumes.

- The results indicate that noise traders play a significant role in determining stock liquidity, particularly for companies with poor corporate governance.

Significance

This study contributes to the existing literature on corporate governance and stock liquidity by providing empirical evidence of their relationship. The findings have important implications for investors, policymakers, and corporate practitioners seeking to improve stock market efficiency.

Technical Contribution

This study develops a new measure of corporate governance quality using a combination of financial and non-financial indicators, which can be used to improve existing research designs.

Novelty

The work presents a novel approach to investigating the relationship between corporate governance and stock liquidity by incorporating noise trader behavior into the analysis.

Limitations

- The sample size is limited to publicly traded companies in a specific country.

- The study relies on secondary data sources, which may introduce measurement errors or biases.

Future Work

- Investigating the causal relationship between corporate governance and stock liquidity using instrumental variables or difference-in-differences approaches.

- Examining the impact of corporate governance on stock liquidity in emerging markets or industries with unique characteristics.

Paper Details

PDF Preview

Key Terms

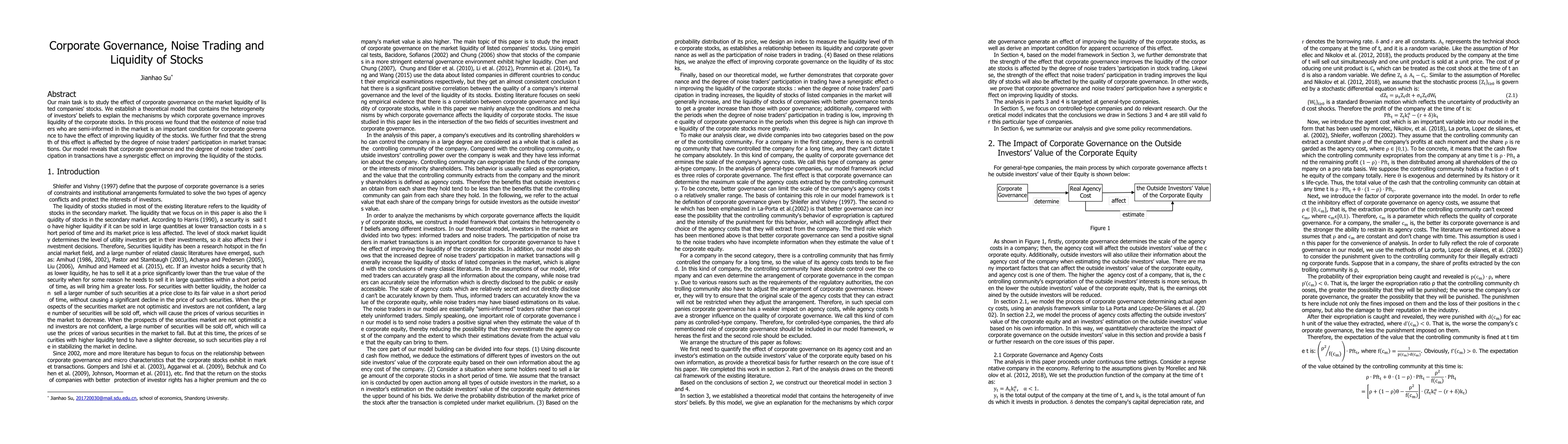

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLiquidity Jump, Liquidity Diffusion, and Treatment on Wash Trading of Crypto Assets

Qi Deng, Zhong-guo Zhou

No citations found for this paper.

Comments (0)