Summary

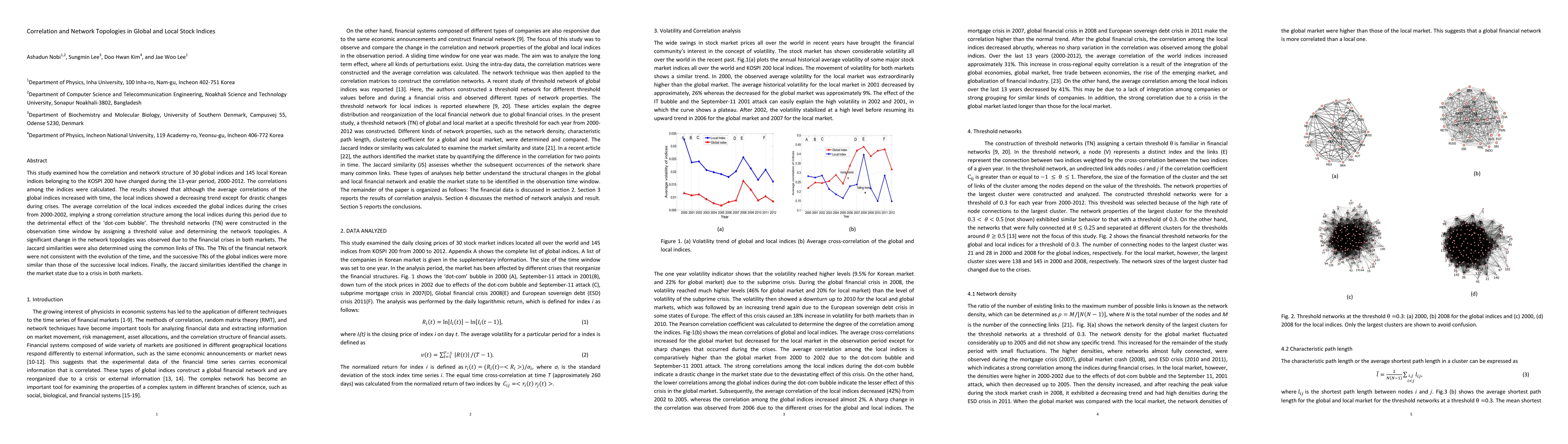

This study examined how the correlation and network structure of 30 global indices and 145 local Korean indices belonging to the KOSPI 200 have changed during the 13-year period, 2000-2012. The correlations among the indices were calculated. The results showed that although the average correlations of the global indices increased with time, the local indices showed a decreasing trend except for drastic changes during crises. The average correlation of the local indices exceeded the global indices during the crises from 2000-2002, implying a strong correlation structure among the local indices during this period due to the detrimental effect of the dot-com bubble. The threshold networks (TN) were constructed in the observation time window by assigning a threshold value and determining the network topologies. A significant change in the network topologies was observed due to the financial crises in both markets. The Jaccard similarities were also determined using the common links of TNs. The TNs of the financial network were not consistent with the evolution of the time, and the successive TNs of the global indices were more similar than those of the successive local indices. Finally, the Jaccard similarities identified the change in the market state due to a crisis in both markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)