Summary

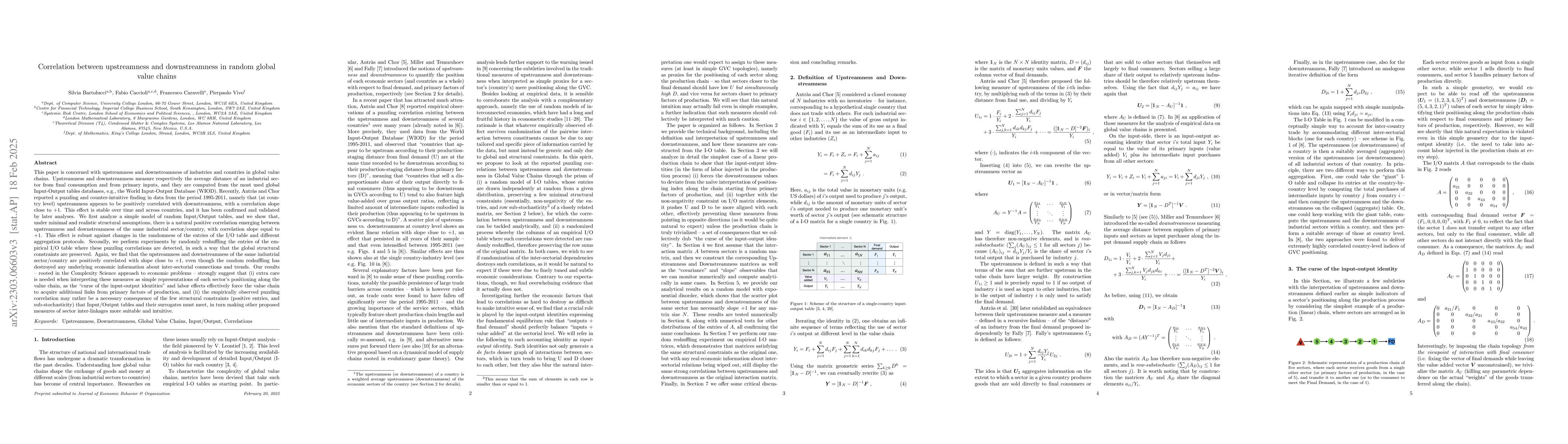

This paper is concerned with upstreamness and downstreamness of industries and countries in global value chains. Upstreamness and downstreamness measure respectively the average distance of an industrial sector from final consumption and from primary inputs, and they are computed from based on the most used global Input-Output tables databases, e.g., the World Input-Output Database (WIOD). Recently, Antr\`as and Chor reported a puzzling and counter-intuitive finding in data from the period 1995-2011, namely that (at country level) upstreamness appears to be positively correlated with downstreamness, with a correlation slope close to $+1$. This effect is stable over time and across countries, and it has been confirmed and validated by later analyses. We first analyze a simple model of random Input/Output tables, and we show that, under minimal and realistic structural assumptions, there is a natural positive correlation emerging between upstreamness and downstreamness of the same industrial sector/country, with correlation slope equal to $+1$. This effect is robust against changes in the randomness of the entries of the I/O table and different aggregation protocols. Secondly, we perform experiments by randomly reshuffling the entries of the empirical I/O table where these puzzling correlations are detected, in such a way that the global structural constraints are preserved. Again, we find that the upstreamness and downstreamness of the same industrial sector/country are positively correlated with slope close to $+1$, even though the random reshuffling has destroyed any underlying economic information about inter-sectorial connections and trends. Our results strongly suggest that the empirically observed puzzling correlation may rather be a necessary consequence of the few structural constraints that Input/Output tables must meet.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersUpstreamness and downstreamness in input-output analysis from local and aggregate information

Francesco Caravelli, Silvia Bartolucci, Pierpaolo Vivo et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)