Summary

Powered with telematics technology, insurers can now capture a wide range of data, such as distance traveled, how drivers brake, accelerate or make turns, and travel frequency each day of the week, to better decode driver's behavior. Such additional information helps insurers improve risk assessments for usage-based insurance (UBI), an increasingly popular industry innovation. In this article, we explore how to integrate telematics information to better predict claims frequency. For motor insurance during a policy year, we typically observe a large proportion of drivers with zero claims, a less proportion with exactly one claim, and far lesser with two or more claims. We introduce the use of a cost-sensitive multi-class adaptive boosting (AdaBoost) algorithm, which we call SAMME.C2, to handle such imbalances. To calibrate SAMME.C2 algorithm, we use empirical data collected from a telematics program in Canada and we find improved assessment of driving behavior with telematics relative to traditional risk variables. We demonstrate our algorithm can outperform other models that can handle class imbalances: SAMME, SAMME with SMOTE, RUSBoost, and SMOTEBoost. The sampled data on telematics were observations during 2013-2016 for which 50,301 are used for training and another 21,574 for testing. Broadly speaking, the additional information derived from vehicle telematics helps refine risk classification of drivers of UBI.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

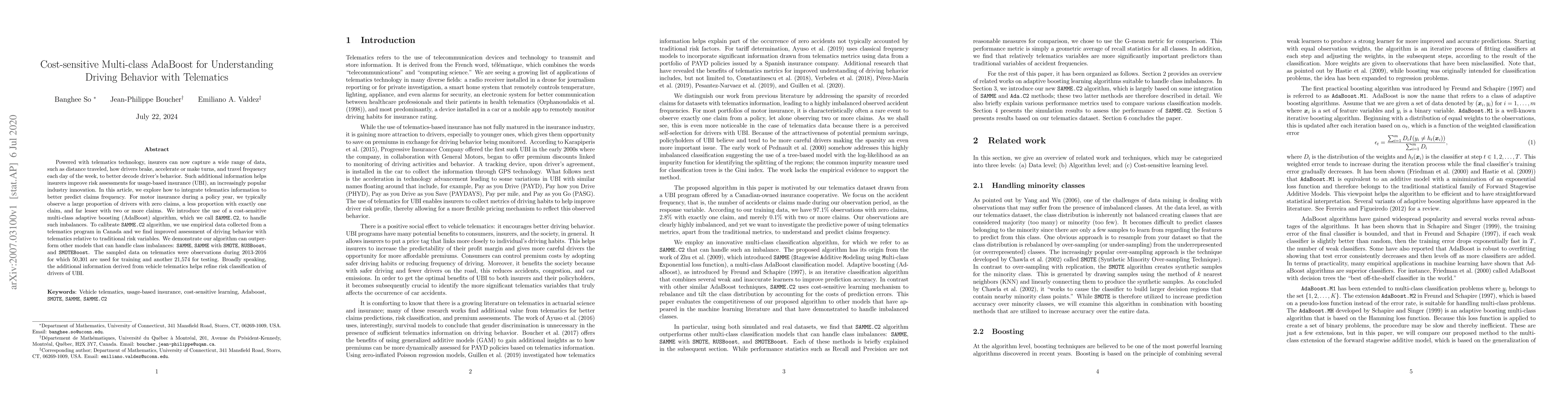

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersData Mining of Telematics Data: Unveiling the Hidden Patterns in Driving Behaviour

Andrei L. Badescu, X. Sheldon Lin, Ian Weng Chan et al.

Neyman-Pearson Multi-class Classification via Cost-sensitive Learning

Yang Feng, Ye Tian

| Title | Authors | Year | Actions |

|---|

Comments (0)