Summary

The sectoral synchronization observed for the Japanese business cycle in the Indices of Industrial Production data is an example of synchronization. The stability of this synchronization under a shock, e.g., fluctuation of supply or demand, is a matter of interest in physics and economics. We consider an economic system made up of industry sectors and goods markets in order to analyze the sectoral synchronization observed for the Japanese business cycle. A coupled oscillator model that exhibits synchronization is developed based on the Kuramoto model with inertia by adding goods markets, and analytic solutions of the stationary state and the coupling strength are obtained. We simulate the effects on synchronization of a sectoral shock for systems with different price elasticities and the coupling strengths. Synchronization is reproduced as an equilibrium solution in a nearest neighbor graph. Analysis of the order parameters shows that the synchronization is stable for a finite elasticity, whereas the synchronization is broken and the oscillators behave like a giant oscillator with a certain frequency additional to the common frequency for zero elasticity.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

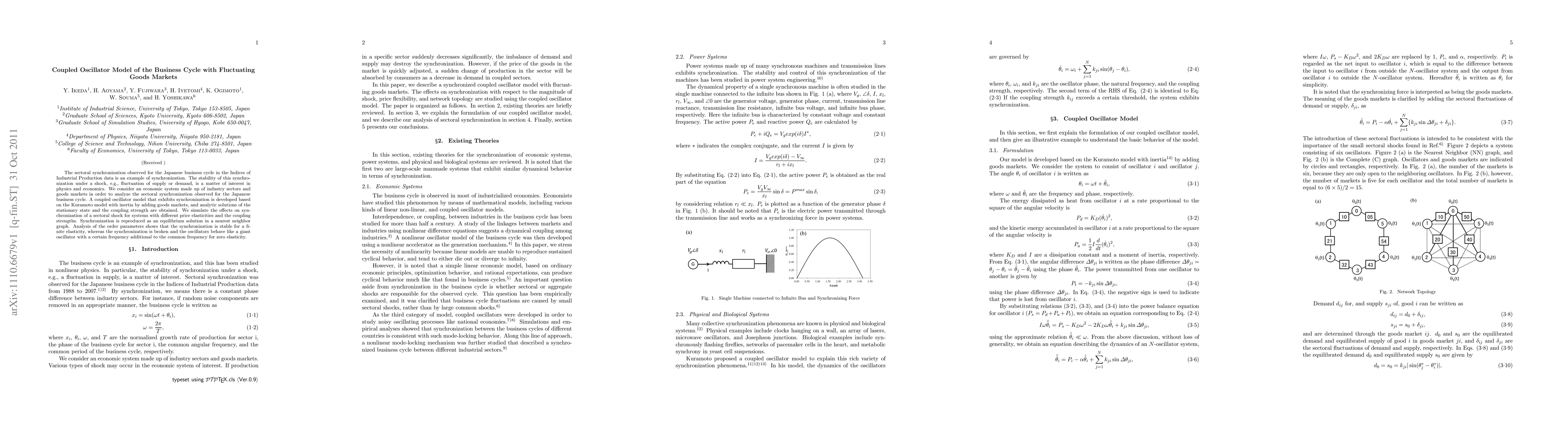

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Bayesian nonlinear stationary model with multiple frequencies for business cycle analysis

Justyna Wróblewska, Łukasz Kwiatkowski, Łukasz Lenart

| Title | Authors | Year | Actions |

|---|

Comments (0)