Summary

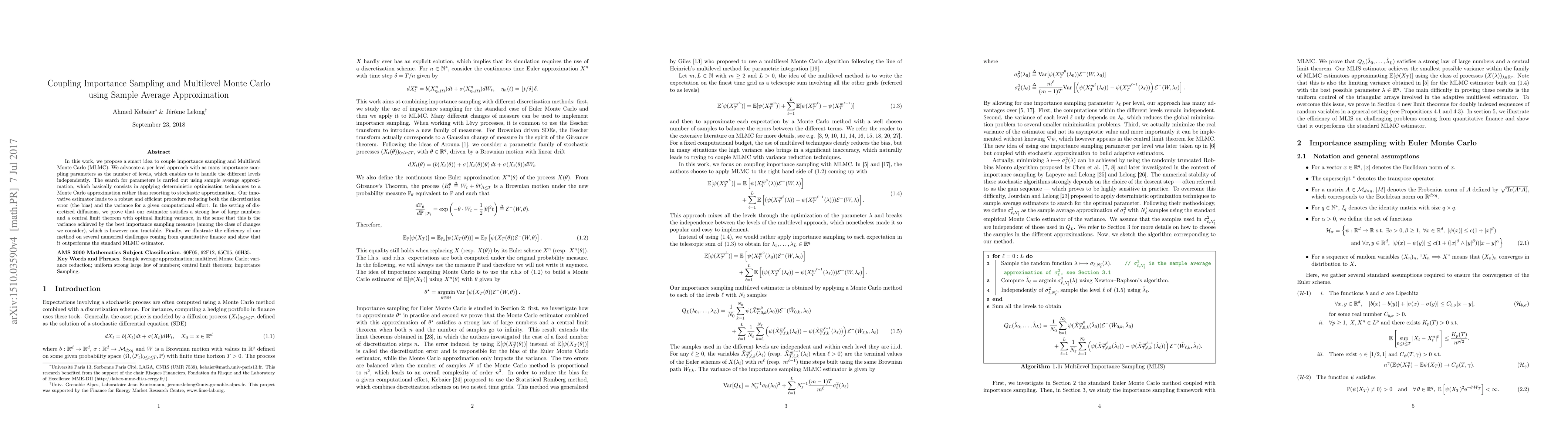

In this work, we propose a smart idea to couple importance sampling and Multilevel Monte Carlo (MLMC). We advocate a per level approach with as many importance sampling parameters as the number of levels, which enables us to compute the different levels independently. The search for parameters is carried out using sample average approximation, which basically consists in applying deterministic optimisation techniques to a Monte Carlo approximation rather than resorting to stochastic approximation. Our innovative estimator leads to a robust and efficient procedure reducing both the discretization error (the bias) and the variance for a given computational effort. In the setting of discretized diffusions, we prove that our estimator satisfies a strong law of large numbers and a central limit theorem with optimal limiting variance, in the sense that this is the variance achieved by the best importance sampling measure (among the class of changes we consider), which is however non tractable. Finally, we illustrate the efficiency of our method on several numerical challenges coming from quantitative finance and show that it outperforms the standard MLMC estimator.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMultilevel Monte Carlo in Sample Average Approximation: Convergence, Complexity and Application

Siddhartha P. Chakrabarty, Devang Sinha

Nested Multilevel Monte Carlo with Biased and Antithetic Sampling

Abdul-Lateef Haji-Ali, Jonathan Spence

| Title | Authors | Year | Actions |

|---|

Comments (0)