Summary

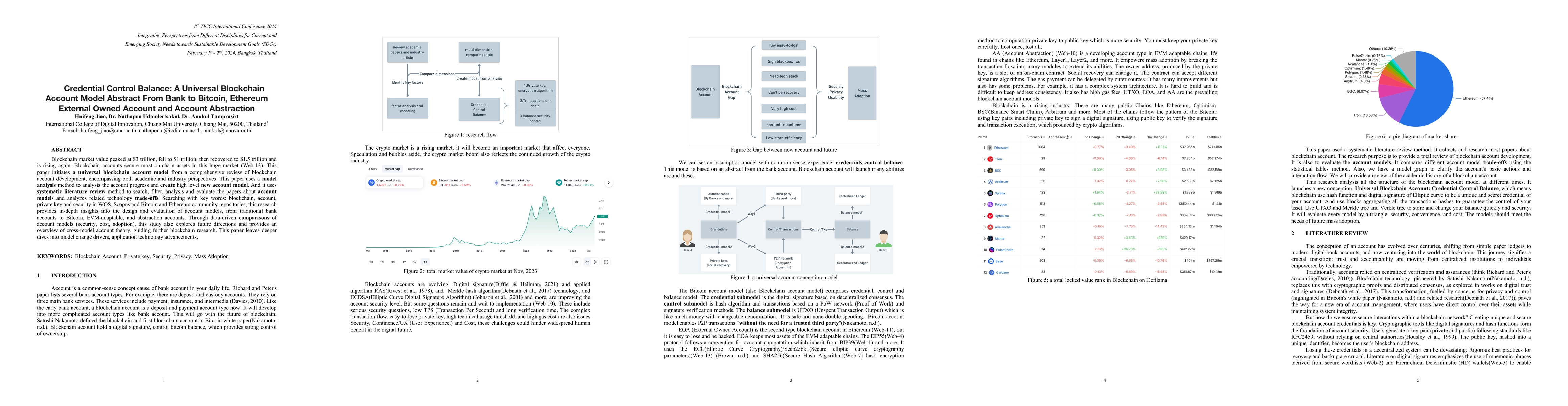

Blockchain market value peaked at $3 trillion, fell to $1 trillion, then recovered to $1.5 trillion and is rising again. Blockchain accounts secure most on-chain assets in this huge market (Web-12). This paper initiates a universal blockchain account model from a comprehensive review of blockchain account development, encompassing both academic and industry perspectives. This paper uses a model analysis method to analysis the account progress and create high level new account model. And it uses systematic literature review method to search, filter, analysis and evaluate the papers about account models and analyzes related technology trade-offs. Searching with key words: blockchain, account, private key and security in WOS, Scopus and Bitcoin and Ethereum community repositories, this research provides in-depth insights into the design and evaluation of account models, from traditional bank accounts to Bitcoin, EVM-adaptable, and abstraction accounts. Through data-driven comparisons of account models (security, cost, adoption), this study also explores future directions and provides an overview of cross-model account theory, guiding further blockchain research. This paper leaves deeper dives into model change drivers, application technology advancements.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersKnow Your Account: Double Graph Inference-based Account De-anonymization on Ethereum

Yang Liu, Wangjie Qiu, Jin Dong et al.

Behavior-aware Account De-anonymization on Ethereum Interaction Graph

Qi Xuan, Jiajun Zhou, Chenkai Hu et al.

RiskProp: Account Risk Rating on Ethereum via De-anonymous Score and Network Propagation

Dan Lin, Ting Chen, Zibin Zheng et al.

No citations found for this paper.

Comments (0)