Summary

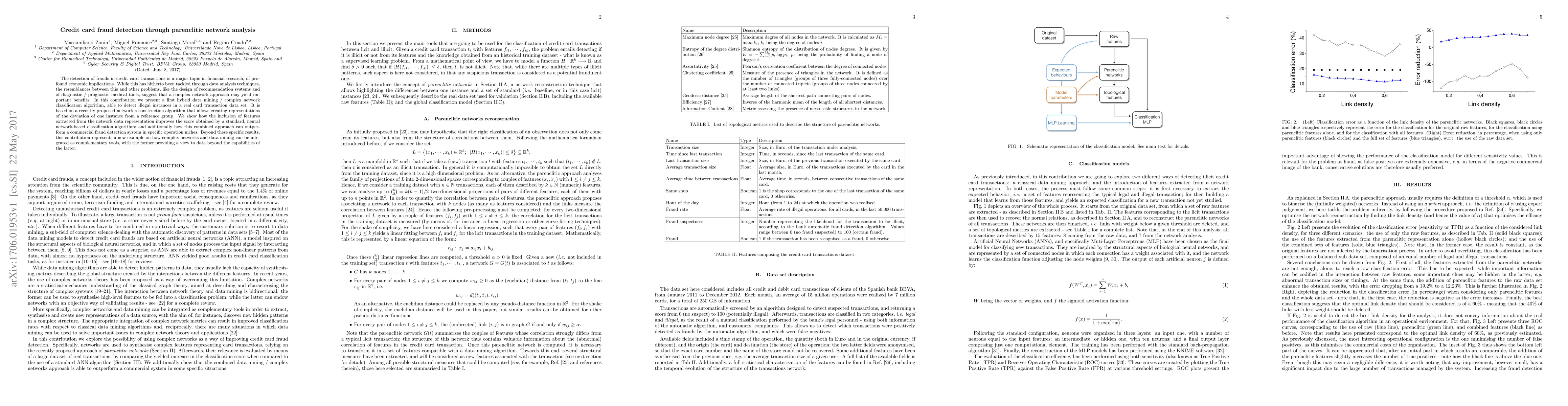

The detection of frauds in credit card transactions is a major topic in financial research, of profound economic implications. While this has hitherto been tackled through data analysis techniques, the resemblances between this and other problems, like the design of recommendation systems and of diagnostic / prognostic medical tools, suggest that a complex network approach may yield important benefits. In this contribution we present a first hybrid data mining / complex network classification algorithm, able to detect illegal instances in a real card transaction data set. It is based on a recently proposed network reconstruction algorithm that allows creating representations of the deviation of one instance from a reference group. We show how the inclusion of features extracted from the network data representation improves the score obtained by a standard, neural network-based classification algorithm; and additionally how this combined approach can outperform a commercial fraud detection system in specific operation niches. Beyond these specific results, this contribution represents a new example on how complex networks and data mining can be integrated as complementary tools, with the former providing a view to data beyond the capabilities of the latter.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCredit Card Fraud Detection: A Deep Learning Approach

Sourav Verma, Joydip Dhar

Enhancing Credit Card Fraud Detection A Neural Network and SMOTE Integrated Approach

Ye Zhang, Yulu Gong, Mengran Zhu et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)