Summary

In this paper we develop a tractable structural model with analytical default probabilities depending on some dynamics parameters, and we show how to calibrate the model using a chosen number of Credit Default Swap (CDS) market quotes. We essentially show how to use structural models with a calibration capability that is typical of the much more tractable credit-spread based intensity models. We apply the structural model to a concrete calibration case and observe what happens to the calibrated dynamics when the CDS-implied credit quality deteriorates as the firm approaches default. Finally we provide a typical example of a case where the calibrated structural model can be used for credit pricing in a much more convenient way than a calibrated reduced form model: The pricing of counterparty risk in an equity swap.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

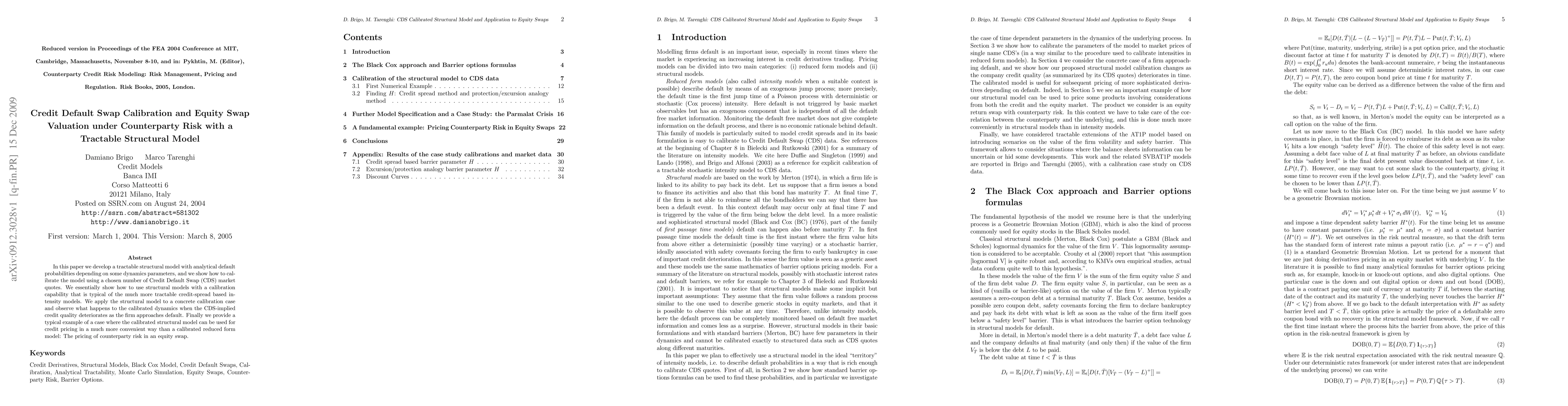

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)