Summary

We review different approaches for measuring the impact of liquidity on CDS prices. We start with reduced form models incorporating liquidity as an additional discount rate. We review Chen, Fabozzi and Sverdlove (2008) and Buhler and Trapp (2006, 2008), adopting different assumptions on how liquidity rates enter the CDS premium rate formula, about the dynamics of liquidity rate processes and about the credit-liquidity correlation. Buhler and Trapp (2008) provides the most general and realistic framework, incorporating correlation between liquidity and credit, liquidity spillover effects between bonds and CDS contracts and asymmetric liquidity effects on the Bid and Ask CDS premium rates. We then discuss the Bongaerts, De Jong and Driessen (2009) study which derives an equilibrium asset pricing model incorporating liquidity effects. Findings include that both expected illiquidity and liquidity risk have a statistically significant impact on expected CDS returns. We finalize our review with a discussion of Predescu et al (2009), which analyzes also data in-crisis. This is a statistical model that associates an ordinal liquidity score with each CDS reference entity and allows one to compare liquidity of over 2400 reference entities. This study points out that credit and illiquidity are correlated, with a smile pattern. All these studies highlight that CDS premium rates are not pure measures of credit risk. Further research is needed to measure liquidity premium at CDS contract level and to disentangle liquidity from credit effectively.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

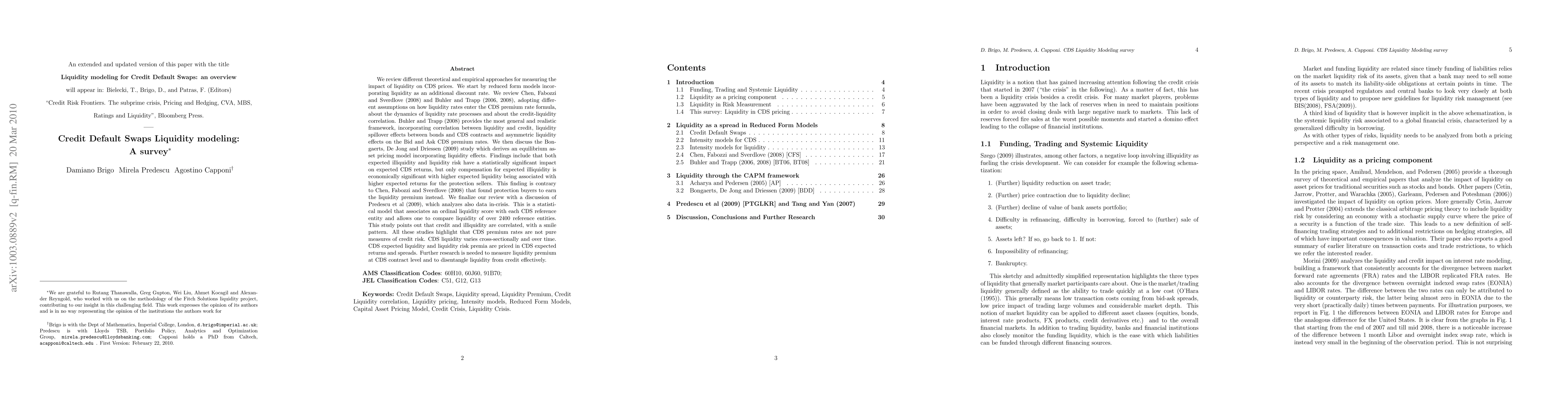

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)