Summary

Credit Valuation Adjustment captures the difference in the value of derivative contracts when the counterparty default probability is taken into account. However, in the context of a network of contracts, the default probability of a direct counterparty can depend substantially on the default probabilities of indirect counterparties. We develop a model to clarify when and how these network effects matter for CVA, in particular in the presence of correlation among counterparties defaults. We provide an approximate analytical solution for the default probabilities. This solution allows for identifying conditions on key parameters such as network degree, leverage and correlation, where network effects yield large differences in CVA (e.g. above 50%), and thus relevant for practical applications. Moreover, we find evidence that network effects induce a multi-modal distribution of CVA values.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

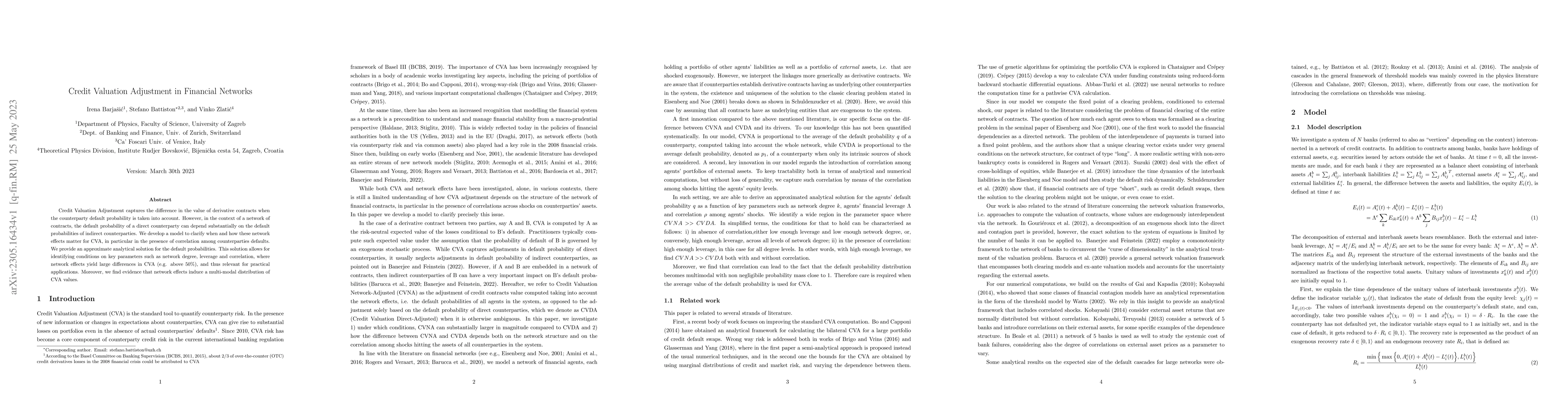

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEfficient Risk Estimation for the Credit Valuation Adjustment

Michael B. Giles, Abdul-Lateef Haji-Ali, Jonathan Spence

Credit Valuation Adjustment with Replacement Closeout: Theory and Algorithms

Wei Wei, Ken Seng Tan, Chaofan Sun

No citations found for this paper.

Comments (0)