Summary

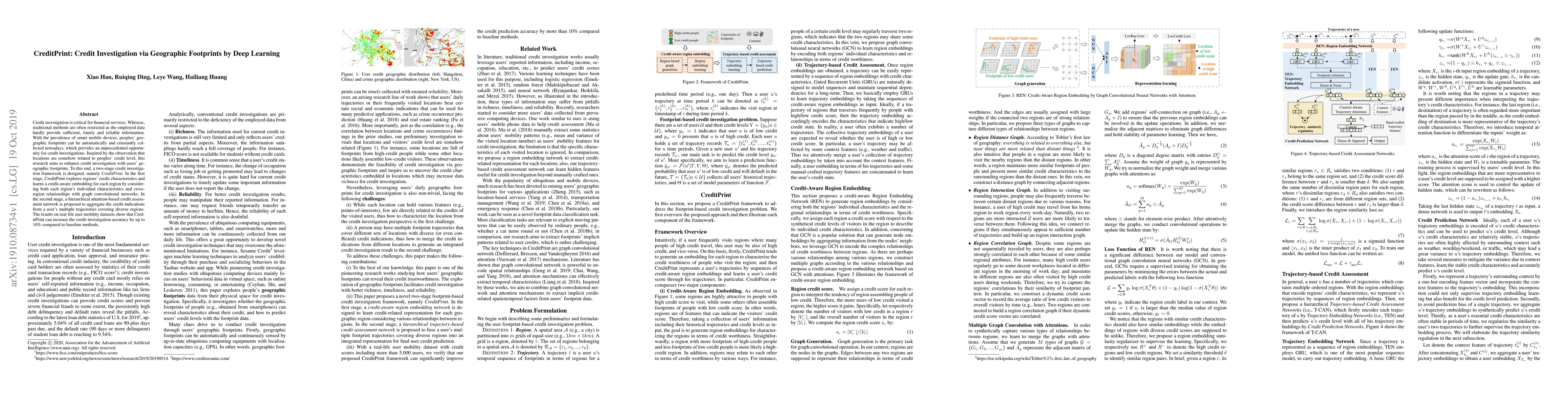

Credit investigation is critical for financial services. Whereas, traditional methods are often restricted as the employed data hardly provide sufficient, timely and reliable information. With the prevalence of smart mobile devices, peoples' geographic footprints can be automatically and constantly collected nowadays, which provides an unprecedented opportunity for credit investigations. Inspired by the observation that locations are somehow related to peoples' credit level, this research aims to enhance credit investigation with users' geographic footprints. To this end, a two-stage credit investigation framework is designed, namely CreditPrint. In the first stage, CreditPrint explores regions' credit characteristics and learns a credit-aware embedding for each region by considering both each region's individual characteristics and cross-region relationships with graph convolutional networks. In the second stage, a hierarchical attention-based credit assessment network is proposed to aggregate the credit indications from a user's multiple trajectories covering diverse regions. The results on real-life user mobility datasets show that CreditPrint can increase the credit investigation accuracy by up to 10% compared to baseline methods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCredit Card Fraud Detection: A Deep Learning Approach

Sourav Verma, Joydip Dhar

Towards Practical Credit Assignment for Deep Reinforcement Learning

Dmitry Vetrov, Riley Simmons-Edler, Vyacheslav Alipov et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)