Summary

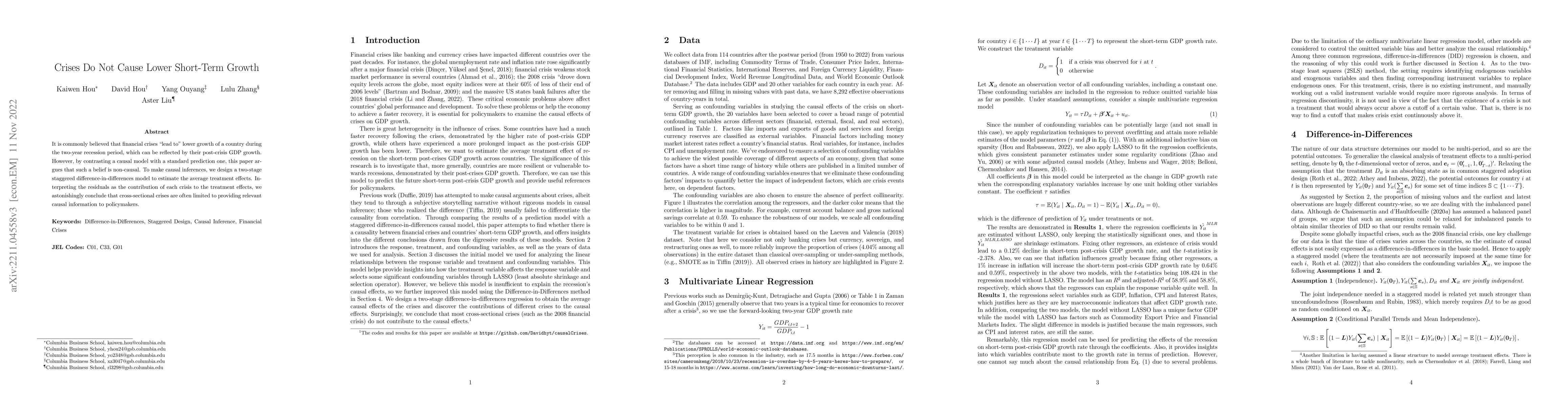

It is commonly believed that financial crises "lead to" lower growth of a country during the two-year recession period, which can be reflected by their post-crisis GDP growth. However, by contrasting a causal model with a standard prediction model, this paper argues that such a belief is non-causal. To make causal inferences, we design a two-stage staggered difference-in-differences model to estimate the average treatment effects. Interpreting the residuals as the contribution of each crisis to the treatment effects, we astonishingly conclude that cross-sectional crises are often limited to providing relevant causal information to policymakers.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersConversations with AI Chatbots Increase Short-Term Vaccine Intentions But Do Not Outperform Standard Public Health Messaging

Sunny Rai, Sharath Chandra Guntuku, Lyle Ungar et al.

No citations found for this paper.

Comments (0)