Summary

We extend the analysis of investment strategies derived from penalized quantile regression models, introducing alternative approaches to improve state\textendash of\textendash art asset allocation rules. First, we use a post\textendash penalization procedure to deal with overshrinking and concentration issues. Second, we investigate whether and to what extent the performance changes when moving from convex to nonconvex penalty functions. Third, we compare different methods to select the optimal tuning parameter which controls the intensity of the penalization. Empirical analyses on real\textendash world data show that these alternative methods outperform the simple LASSO. This evidence becomes stronger when focusing on the extreme risk, which is strictly linked to the quantile regression method.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

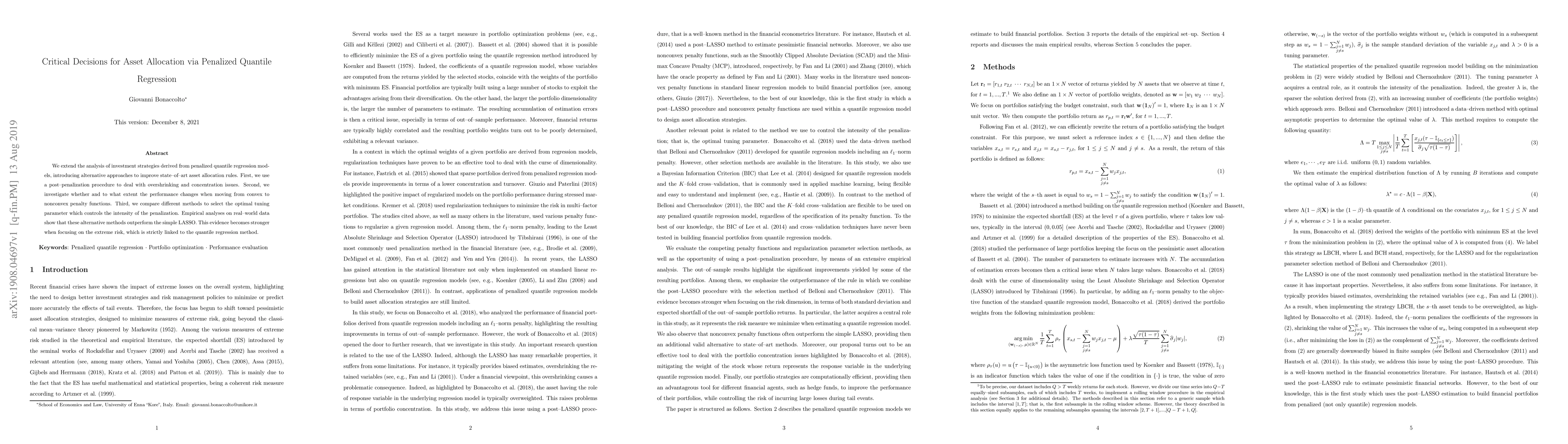

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Unified Algorithm for Penalized Convolution Smoothed Quantile Regression

Wen-Xin Zhou, Kean Ming Tan, Rebeka Man et al.

No citations found for this paper.

Comments (0)