Summary

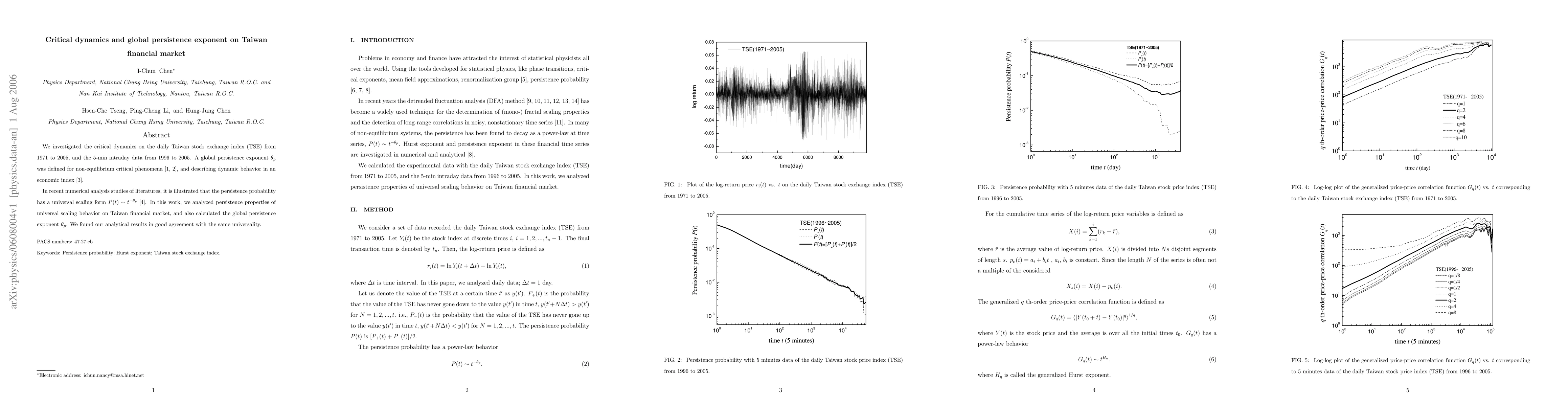

We investigated the critical dynamics on the daily Taiwan stock exchange index (TSE) from 1971 to 2005, and the 5-min intraday data from 1996 to 2005. A global persistence exponent $\theta_{p}$ was defined for non-equilibrium critical phenomena \cite{Janssen,Majumdar}, and describing dynamic behavior in an economic index \cite{Zheng}. In recent numerical analysis studies of literatures, it is illustrated that the persistence probability has a universal scaling form $P(t) \sim t^{-\theta_{p}}$ \cite{Zheng1}. In this work, we analyzed persistence properties of universal scaling behavior on Taiwan financial market, and also calculated the global persistence exponent $\theta_{p}$. We found our analytical results in good agreement with the same universality.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Comments (0)