Summary

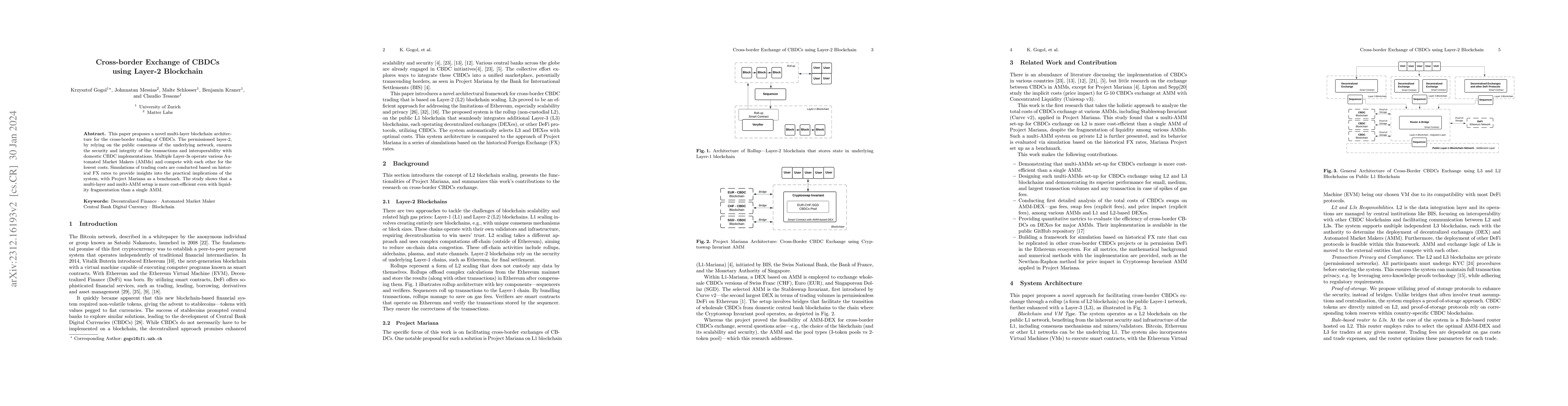

This paper proposes a novel multi-layer blockchain architecture for the cross-border trading of CBDCs. The permissioned layer-2, by relying on the public consensus of the underlying network, assures the security and integrity of the transactions and ensures interoperability with domestic CBDCs implementations. Multiple Layer-3s operate various Automated Market Makers (AMMs) and compete with each other for the lowest costs. To provide insights into the practical implications of the system, simulations of trading costs are conducted based on historical FX rates, with Project Mariana as a benchmark. The study shows that, even with liquidity fragmentation, a multi-layer and multi-AMM setup is more cost-efficient than a single AMM.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Discussion about Computational Challenges of Programmable Money in Blockchain-based CBDCs

Roman Vitenberg, Arlindo F. da Conceição

Advancing Blockchain Scalability: An Introduction to Layer 1 and Layer 2 Solutions

Han Song, Zhongche Qu, Yihao Wei

| Title | Authors | Year | Actions |

|---|

Comments (0)