Summary

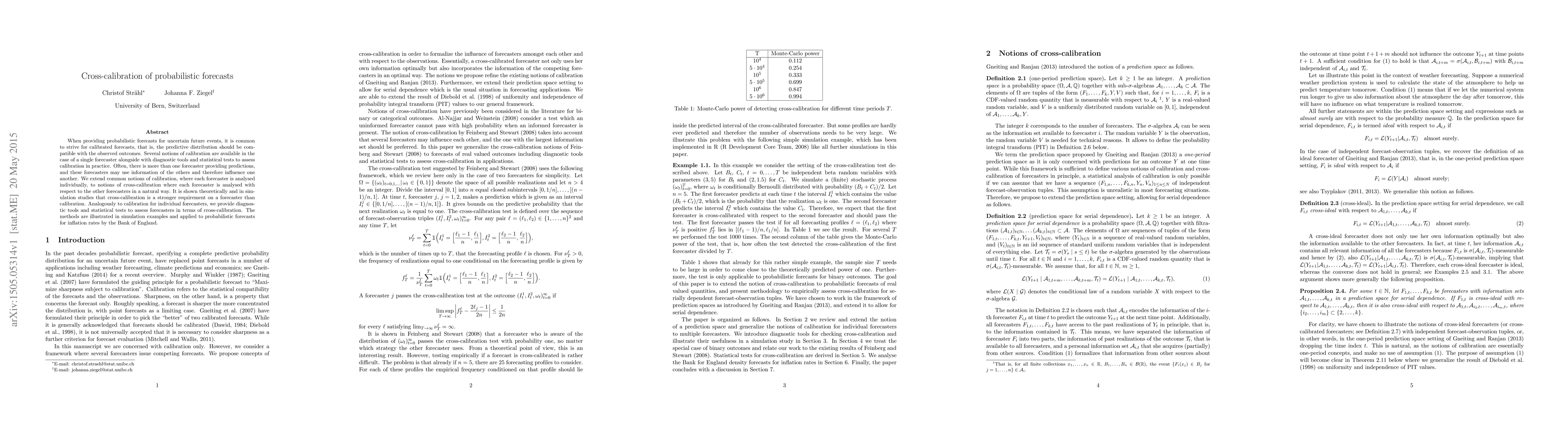

When providing probabilistic forecasts for uncertain future events, it is common to strive for calibrated forecasts, that is, the predictive distribution should be compatible with the observed outcomes. Several notions of calibration are available in the case of a single forecaster alongside with diagnostic tools and statistical tests to assess calibration in practice. Often, there is more than one forecaster providing predictions, and these forecasters may use information of the others and therefore influence one another. We extend common notions of calibration, where each forecaster is analysed individually, to notions of cross-calibration where each forecaster is analysed with respect to the other forecasters in a natural way. It is shown theoretically and in simulation studies that cross-calibration is a stronger requirement on a forecaster than calibration. Analogously to calibration for individual forecasters, we provide diagnostic tools and statistical tests to assess forecasters in terms of cross-calibration. The methods are illustrated in simulation examples and applied to probabilistic forecasts for inflation rates by the Bank of England.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTail calibration of probabilistic forecasts

Sam Allen, Jonathan Koh, Johan Segers et al.

Assessing the calibration of multivariate probabilistic forecasts

Sam Allen, Johanna Ziegel, David Ginsbourger

| Title | Authors | Year | Actions |

|---|

Comments (0)