Authors

Summary

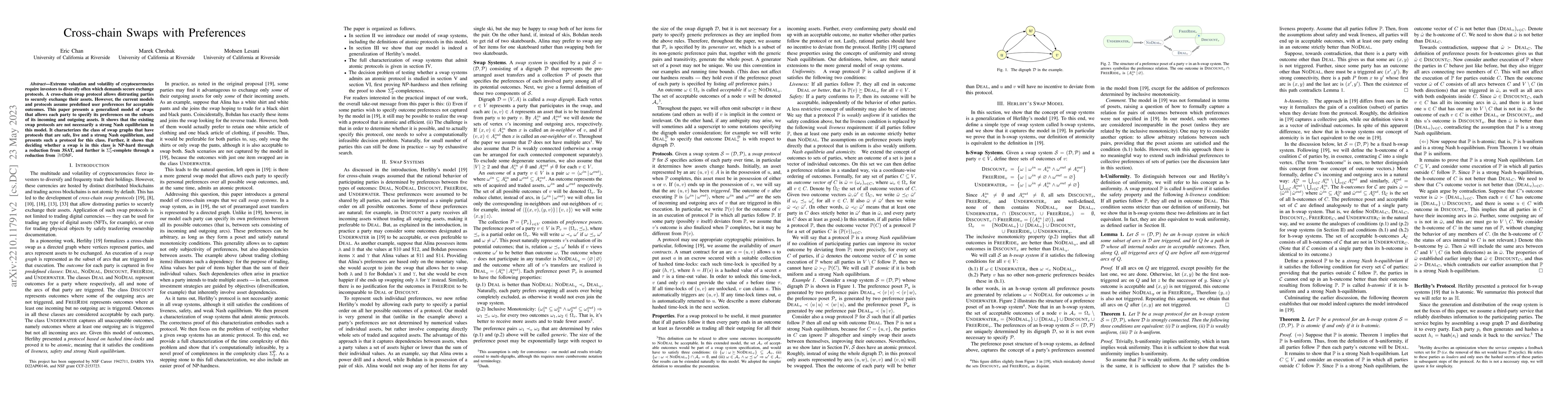

Extreme valuation and volatility of cryptocurrencies require investors to diversify often which demands secure exchange protocols. A cross-chain swap protocol allows distrusting parties to securely exchange their assets. However, the current models and protocols assume predefined user preferences for acceptable outcomes. This paper presents a generalized model of swaps that allows each party to specify its preferences on the subsets of its incoming and outgoing assets. It shows that the existing swap protocols are not necessarily a strong Nash equilibrium in this model. It characterizes the class of swap graphs that have protocols that are safe, live and a strong Nash equilibrium, and presents such a protocol for this class. Further, it shows that deciding whether a swap is in this class is NP-hard through a reduction from 3SAT, and further is $\Sigma_2^{\mathsf{P}}$-complete through a reduction from $\exists\forall\mathsf{DNF}$.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInvited Paper: Fault-tolerant and Expressive Cross-Chain Swaps

Yingjie Xue, Di Jin, Maurice Herlihy

VORTEX: Real-Time Off-Chain Payments and Cross-Chain Swaps for Cryptocurrencies

Kui Ren, Di Wu, Jian Liu et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)