Summary

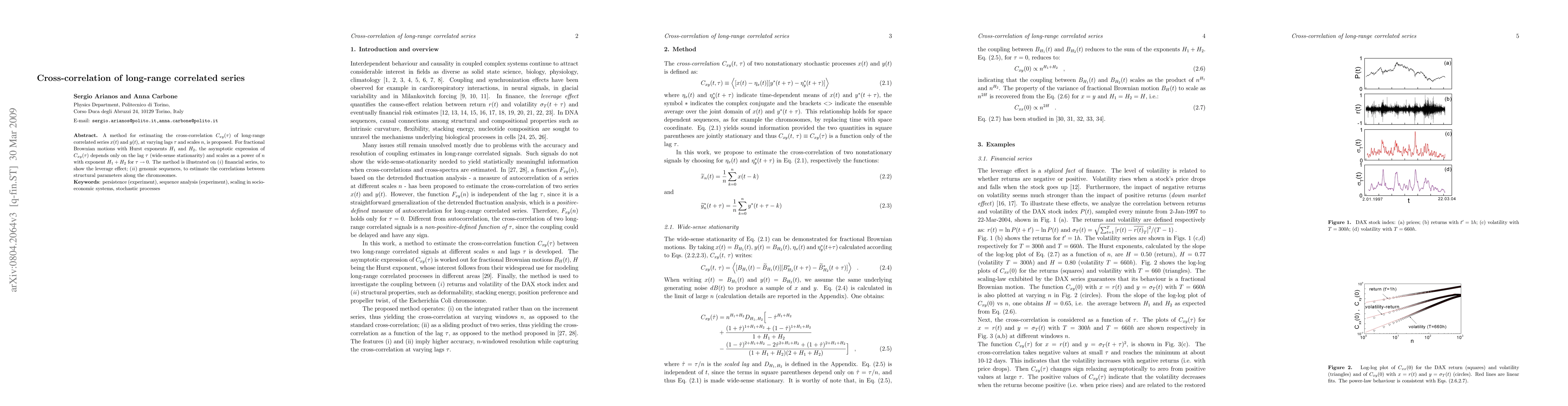

A method for estimating the cross-correlation $C_{xy}(\tau)$ of long-range correlated series $x(t)$ and $y(t)$, at varying lags $\tau$ and scales $n$, is proposed. For fractional Brownian motions with Hurst exponents $H_1$ and $H_2$, the asymptotic expression of $C_{xy}(\tau)$ depends only on the lag $\tau$ (wide-sense stationarity) and scales as a power of $n$ with exponent ${H_1+H_2}$ for $\tau\to 0$. The method is illustrated on (i) financial series, to show the leverage effect; (ii) genomic sequences, to estimate the correlations between structural parameters along the chromosomes.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)