Summary

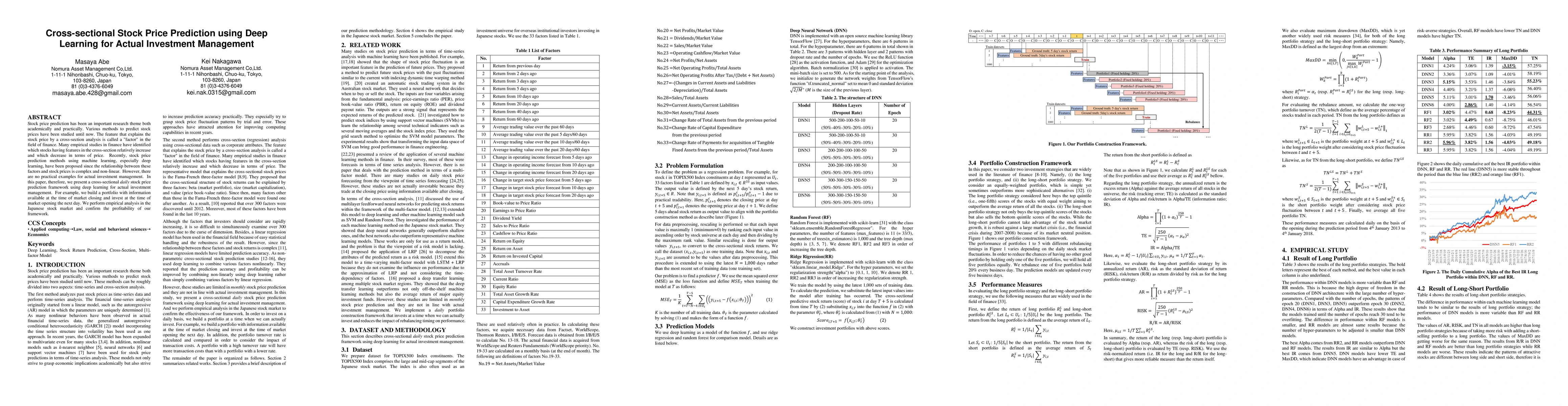

Stock price prediction has been an important research theme both academically and practically. Various methods to predict stock prices have been studied until now. The feature that explains the stock price by a cross-section analysis is called a "factor" in the field of finance. Many empirical studies in finance have identified which stocks having features in the cross-section relatively increase and which decrease in terms of price. Recently, stock price prediction methods using machine learning, especially deep learning, have been proposed since the relationship between these factors and stock prices is complex and non-linear. However, there are no practical examples for actual investment management. In this paper, therefore, we present a cross-sectional daily stock price prediction framework using deep learning for actual investment management. For example, we build a portfolio with information available at the time of market closing and invest at the time of market opening the next day. We perform empirical analysis in the Japanese stock market and confirm the profitability of our framework.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTransformer-Based Deep Learning Model for Stock Price Prediction: A Case Study on Bangladesh Stock Market

Mohammad Shafiul Alam, Muhammad Ibrahim, Tashreef Muhammad et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)