Summary

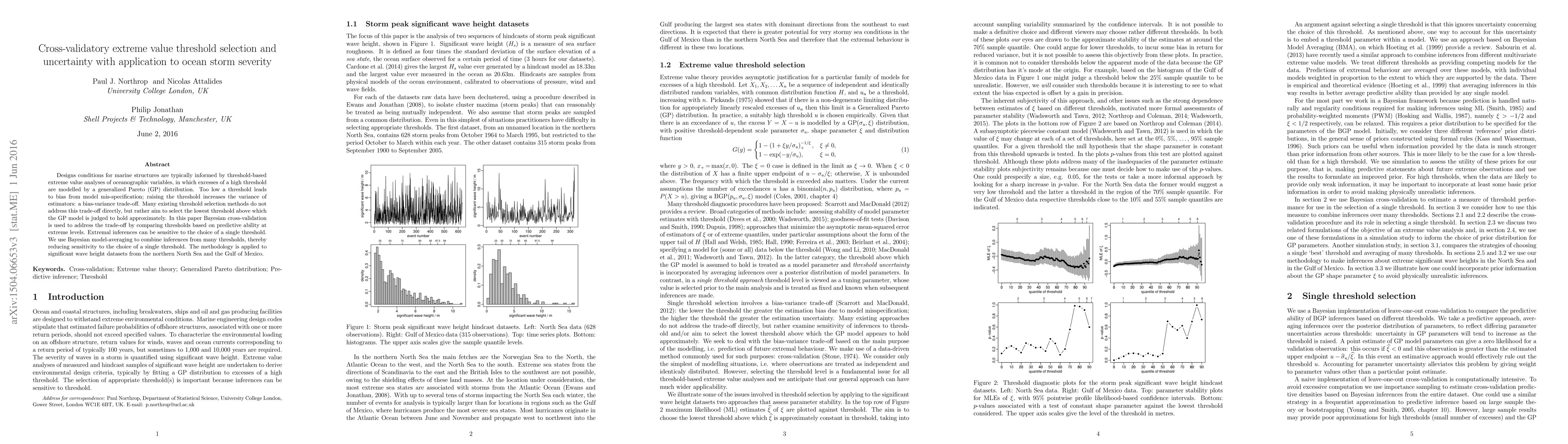

Designs conditions for marine structures are typically informed by threshold-based extreme value analyses of oceanographic variables, in which excesses of a high threshold are modelled by a generalized Pareto (GP) distribution. Too low a threshold leads to bias from model mis-specification; raising the threshold increases the variance of estimators: a bias-variance trade-off. Many existing threshold selection methods do not address this trade-off directly, but rather aim to select the lowest threshold above which the GP model is judged to hold approximately. In this paper Bayesian cross-validation is used to address the trade-off by comparing thresholds based on predictive ability at extreme levels. Extremal inferences can be sensitive to the choice of a single threshold. We use Bayesian model-averaging to combine inferences from many thresholds, thereby reducing sensitivity to the choice of a single threshold. The methodology is applied to significant wave height datasets from the northern North Sea and the Gulf of Mexico.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAutomated threshold selection and associated inference uncertainty for univariate extremes

Conor Murphy, Jonathan A. Tawn, Zak Varty

| Title | Authors | Year | Actions |

|---|

Comments (0)