Authors

Summary

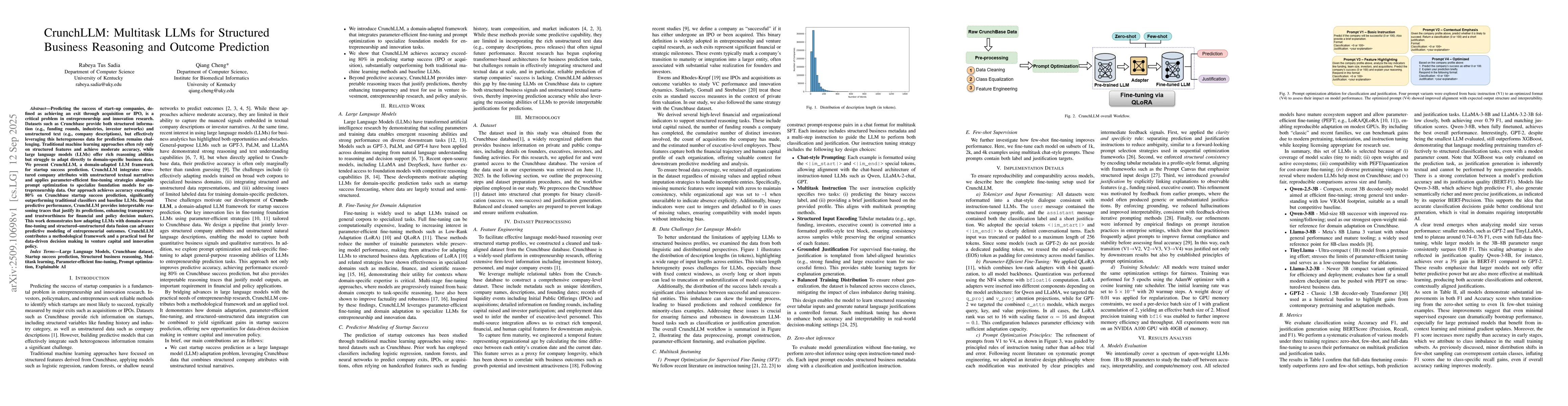

Predicting the success of start-up companies, defined as achieving an exit through acquisition or IPO, is a critical problem in entrepreneurship and innovation research. Datasets such as Crunchbase provide both structured information (e.g., funding rounds, industries, investor networks) and unstructured text (e.g., company descriptions), but effectively leveraging this heterogeneous data for prediction remains challenging. Traditional machine learning approaches often rely only on structured features and achieve moderate accuracy, while large language models (LLMs) offer rich reasoning abilities but struggle to adapt directly to domain-specific business data. We present \textbf{CrunchLLM}, a domain-adapted LLM framework for startup success prediction. CrunchLLM integrates structured company attributes with unstructured textual narratives and applies parameter-efficient fine-tuning strategies alongside prompt optimization to specialize foundation models for entrepreneurship data. Our approach achieves accuracy exceeding 80\% on Crunchbase startup success prediction, significantly outperforming traditional classifiers and baseline LLMs. Beyond predictive performance, CrunchLLM provides interpretable reasoning traces that justify its predictions, enhancing transparency and trustworthiness for financial and policy decision makers. This work demonstrates how adapting LLMs with domain-aware fine-tuning and structured--unstructured data fusion can advance predictive modeling of entrepreneurial outcomes. CrunchLLM contributes a methodological framework and a practical tool for data-driven decision making in venture capital and innovation policy.

AI Key Findings

Generated Oct 13, 2025

Methodology

CrunchLLM integrates structured company attributes with unstructured textual narratives using parameter-efficient fine-tuning and prompt optimization. It employs multitask learning for classification and justification generation, combining structured data with textual descriptions through chat-style prompts and LoRA adapters.

Key Results

- CrunchLLM achieves over 80% accuracy in predicting startup success (IPO/acquisition), significantly outperforming traditional classifiers and baseline LLMs.

- The model provides interpretable reasoning traces that justify predictions, enhancing transparency for decision-makers.

- Larger models (3B-8B parameters) show better performance in both prediction and justification tasks, with Qwen-3-8B achieving the highest F1 score of 0.90.

Significance

This research advances predictive modeling of entrepreneurial outcomes by demonstrating how domain-adapted LLMs can effectively leverage structured and unstructured business data. It offers practical tools for venture capital and innovation policy decision-making through interpretable AI.

Technical Contribution

CrunchLLM introduces a domain-adapted LLM framework with parameter-efficient fine-tuning, structured-unstructured data fusion, and prompt optimization for multitask learning in business reasoning.

Novelty

The work combines structured business data with textual narratives through chat-style prompts and LoRA adapters, achieving both high predictive accuracy and interpretable reasoning for startup success prediction.

Limitations

- The analysis cannot establish causality as identified factors are correlates rather than causal determinants.

- Crunchbase data coverage may vary by sector, geography, and vintage, potentially affecting feature importance.

Future Work

- Evaluate across additional time periods and geographies to assess generalization.

- Incorporate richer signals like founder/investor networks and regulatory filings with explicit temporal dynamics.

- Study calibration and fairness to mitigate bias, and integrate causal and counterfactual analyses for 'what-if' reasoning.

Paper Details

PDF Preview

Similar Papers

Found 4 papersPatient Outcome and Zero-shot Diagnosis Prediction with Hypernetwork-guided Multitask Learning

Shaoxiong Ji, Pekka Marttinen

Towards a Benchmark for Causal Business Process Reasoning with LLMs

Lior Limonad, Fabiana Fournier, Inna Skarbovsky

Can LLMs perform structured graph reasoning?

Cheston Tan, Palaash Agrawal, Shavak Vasania

OncoReason: Structuring Clinical Reasoning in LLMs for Robust and Interpretable Survival Prediction

Raghu Vamshi Hemadri, Kristi Topollai, Geetha Krishna Guruju et al.

Comments (0)