Summary

We review different classes of cryptocurrencies with emphasis on their economic properties. Pure-asset coins such as Bitcoin, Ethereum and Ripple are characterized by not being a liability of any economic agent and most resemble commodities such as gold. Central bank digital currencies, at the other end of the economic spectrum, are liabilities of a Central Bank and most resemble cash. In between, there exist a range of so-called stable coins, with varying degrees of economic complexity. We use balance sheet operations to highlight the properties of each class of cryptocurrency and their potential uses. In addition, we propose the basic structure for a macroeconomic model incorporating all the different types of cryptocurrencies under consideration.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

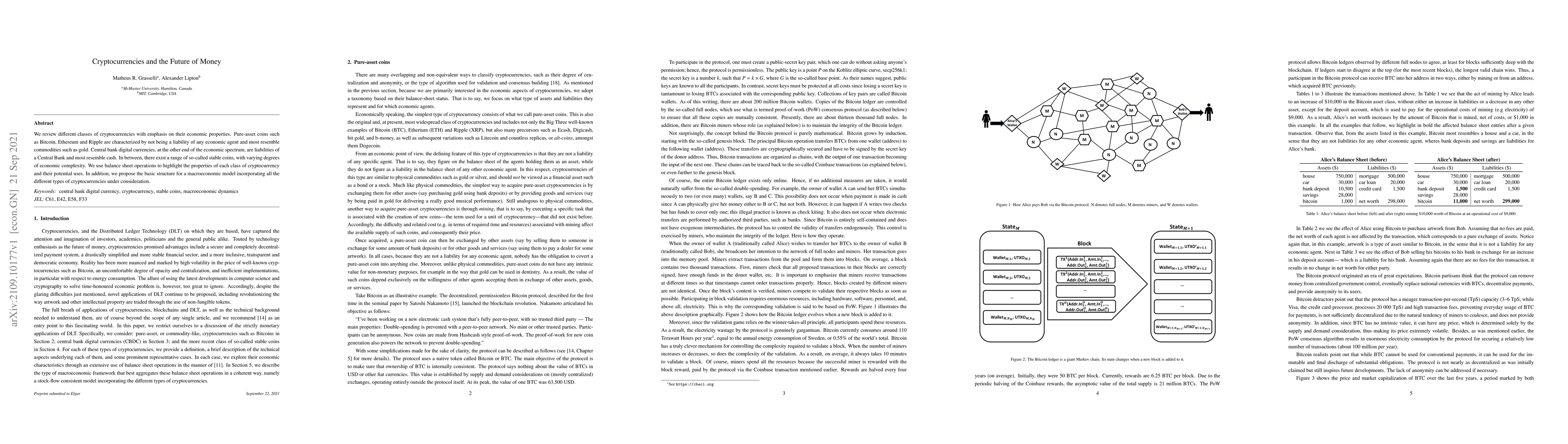

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)