Authors

Summary

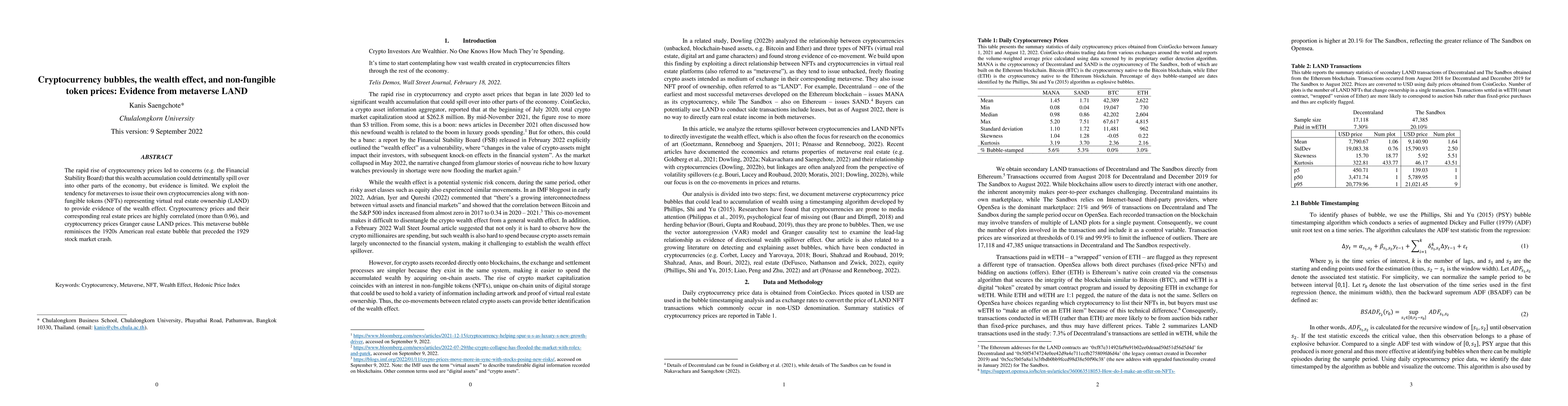

The rapid rise of cryptocurrency prices led to concerns (e.g. the Financial Stability Board) that this wealth accumulation could detrimentally spill over into other parts of the economy, but evidence is limited. We exploit the tendency for metaverses to issue their own cryptocurrencies along with non-fungible tokens (NFTs) representing virtual real estate ownership (LAND) to provide evidence of the wealth effect. Cryptocurrency prices and their corresponding real estate prices are highly correlated (more than 0.96), and cryptocurrency prices Granger cause LAND prices. This metaverse bubble reminisces the 1920s American real estate bubble that preceded the 1929 stock market crash.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSemantics and Non-Fungible Tokens for Copyright Management on the Metaverse and Beyond

Roberto García, Ana Cediel, Mercè Teixidó et al.

Is Metaverse LAND a good investment? It depends on your unit of account!

Kanis Saengchote, Voraprapa Nakavachara

The Perception of Filipinos on the Advent of Cryptocurrency and Non-Fungible Token (NFT) Games

Nelson Rodelas, Ryan Francisco, John Edison Ubaldo

| Title | Authors | Year | Actions |

|---|

Comments (0)