Summary

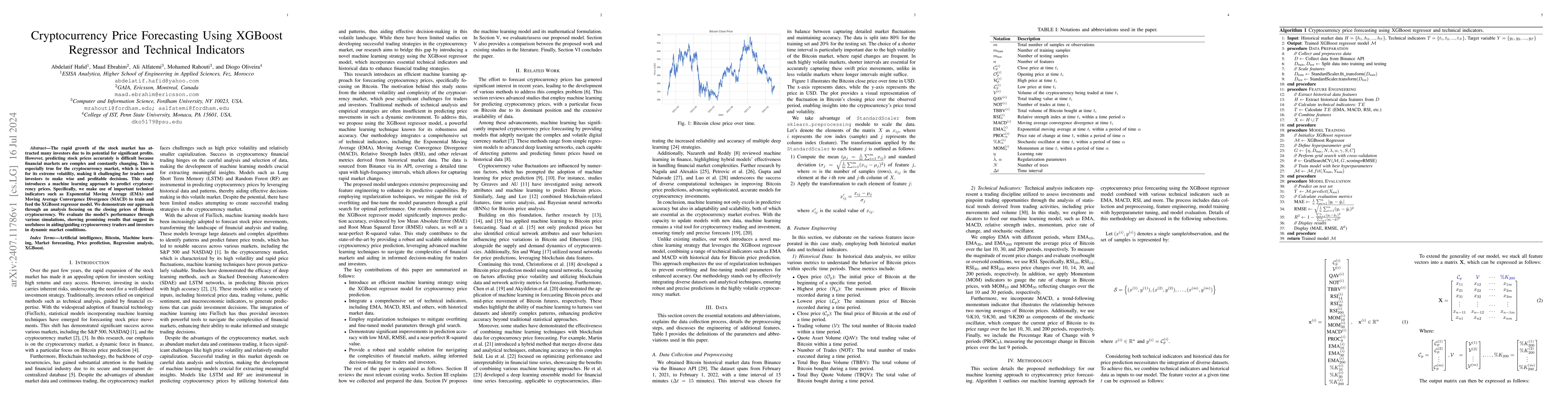

The rapid growth of the stock market has attracted many investors due to its potential for significant profits. However, predicting stock prices accurately is difficult because financial markets are complex and constantly changing. This is especially true for the cryptocurrency market, which is known for its extreme volatility, making it challenging for traders and investors to make wise and profitable decisions. This study introduces a machine learning approach to predict cryptocurrency prices. Specifically, we make use of important technical indicators such as Exponential Moving Average (EMA) and Moving Average Convergence Divergence (MACD) to train and feed the XGBoost regressor model. We demonstrate our approach through an analysis focusing on the closing prices of Bitcoin cryptocurrency. We evaluate the model's performance through various simulations, showing promising results that suggest its usefulness in aiding/guiding cryptocurrency traders and investors in dynamic market conditions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)