Summary

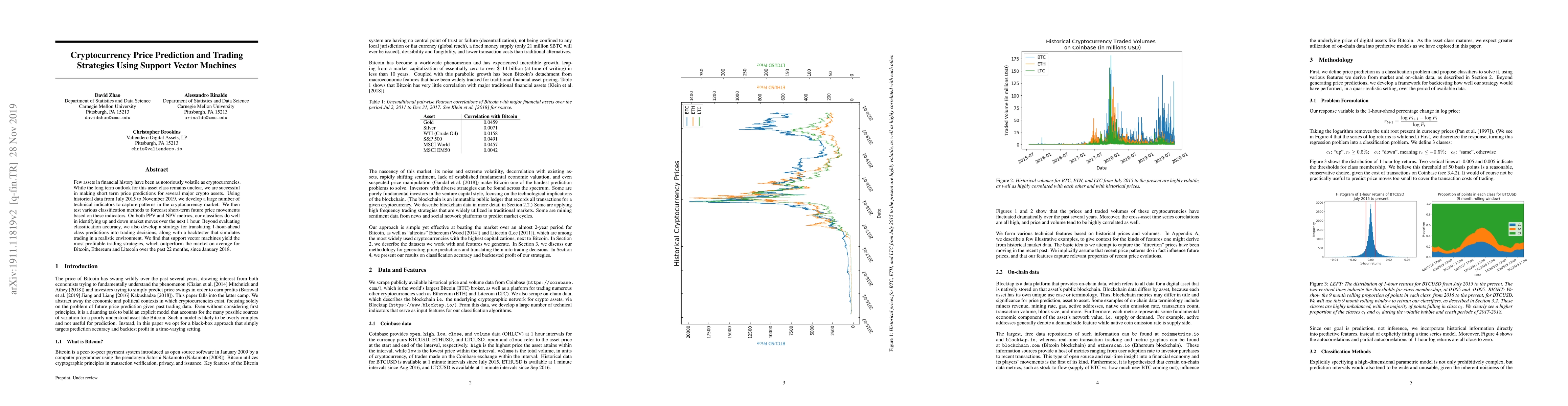

Few assets in financial history have been as notoriously volatile as cryptocurrencies. While the long term outlook for this asset class remains unclear, we are successful in making short term price predictions for several major crypto assets. Using historical data from July 2015 to November 2019, we develop a large number of technical indicators to capture patterns in the cryptocurrency market. We then test various classification methods to forecast short-term future price movements based on these indicators. On both PPV and NPV metrics, our classifiers do well in identifying up and down market moves over the next 1 hour. Beyond evaluating classification accuracy, we also develop a strategy for translating 1-hour-ahead class predictions into trading decisions, along with a backtester that simulates trading in a realistic environment. We find that support vector machines yield the most profitable trading strategies, which outperform the market on average for Bitcoin, Ethereum and Litecoin over the past 22 months, since January 2018.

AI Key Findings

Generated Sep 07, 2025

Methodology

The research uses historical cryptocurrency data from July 2015 to November 2019, develops technical indicators, and applies various classification methods, including Support Vector Machines (SVM), to predict short-term price movements. A trading strategy based on SVM predictions is then tested and compared to market performance.

Key Results

- SVM outperforms other methods (random forest, XGBoost) in identifying short-term price movements (1-hour ahead) based on positive predictive value (PPV) and negative predictive value (NPV) metrics.

- A trading strategy based on SVM outperforms the market on average for Bitcoin, Ethereum, and Litecoin from January 2018 to the present, generating higher returns with lower volatility.

- The SVM strategy tends to trade more during periods of higher market volatility and avoids trading in low volatility periods, reducing overall volatility.

Significance

This research demonstrates the potential of using SVM for short-term cryptocurrency price prediction and trading, offering a profitable strategy that outperforms the market for major crypto assets.

Technical Contribution

The paper presents an effective use of Support Vector Machines for short-term cryptocurrency price prediction, along with a trading strategy based on these predictions that outperforms the market.

Novelty

The research distinguishes itself by focusing on short-term predictions with a trading strategy, demonstrating superior performance compared to other classification methods and the market for major cryptocurrencies.

Limitations

- The study focuses on short-term predictions and does not explore long-term market trends.

- The research is limited to three cryptocurrencies (Bitcoin, Ethereum, Litecoin) and may not generalize to other crypto assets.

- The methodology relies on historical data and may not account for unforeseen market changes or events.

Future Work

- Explore other time horizons, such as medium-term or long-term predictions, for cryptocurrency markets.

- Investigate the applicability of the SVM strategy to a broader range of cryptocurrencies and altcoins.

- Incorporate additional data sources, such as sentiment analysis from news articles and social media, to enhance prediction accuracy.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersUtilizing RNN for Real-time Cryptocurrency Price Prediction and Trading Strategy Optimization

Shamima Nasrin Tumpa, Kehelwala Dewage Gayan Maduranga

Cryptocurrency Price Prediction using Twitter Sentiment Analysis

Haritha GB, Sahana N. B

| Title | Authors | Year | Actions |

|---|

Comments (0)