Summary

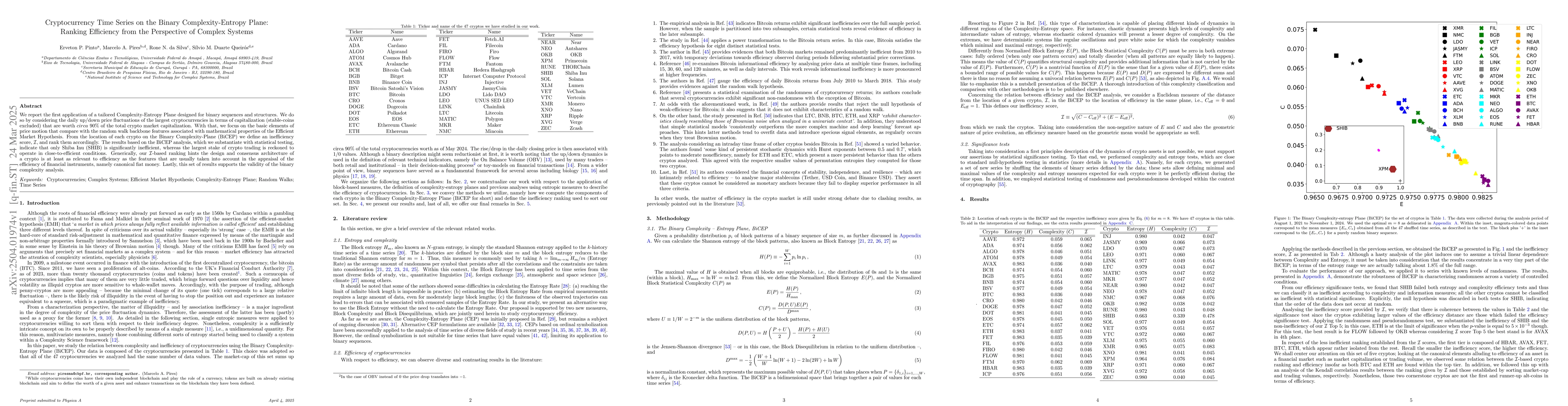

We report the first application of a tailored Complexity-Entropy Plane designed for binary sequences and structures. We do so by considering the daily up/down price fluctuations of the largest cryptocurrencies in terms of capitalization (stable-coins excluded) that are worth $circa \,\, 90 \%$ of the total crypto market capitalization. With that, we focus on the basic elements of price motion that compare with the random walk backbone features associated with mathematical properties of the Efficient Market Hypothesis. From the location of each crypto on the Binary Complexity-Plane (BiCEP) we define an inefficiency score, $\mathcal I$, and rank them accordingly. The results based on the BiCEP analysis, which we substantiate with statistical testing, indicate that only Shiba Inu (SHIB) is significantly inefficient, whereas the largest stake of crypto trading is reckoned to operate in close-to-efficient conditions. Generically, our $\mathcal I$-based ranking hints the design and consensus architecture of a crypto is at least as relevant to efficiency as the features that are usually taken into account in the appraisal of the efficiency of financial instruments, namely canonical fiat money. Lastly, this set of results supports the validity of the binary complexity analysis.

AI Key Findings

Generated Jun 10, 2025

Methodology

The research applies a tailored Complexity-Entropy Plane (BiCEP) to daily up/down price fluctuations of major cryptocurrencies, excluding stablecoins, to rank their efficiency. The inefficiency score, $\mathcal I$, is derived from the Euclidean distance from each crypto's location in the BiCEP to the efficiency point (Ceff=0, Eeff=1).

Key Results

- Only Shiba Inu (SHIB) is classified as significantly inefficient.

- The majority of crypto trading is found to operate in close-to-efficient conditions.

- The design and consensus architecture of a crypto are as relevant to efficiency as traditional efficiency features of financial instruments.

Significance

This research supports the validity of binary complexity analysis in evaluating cryptocurrency efficiency, providing insights into how crypto assets compare to conventional financial instruments in terms of efficiency.

Technical Contribution

The introduction and application of the Binary Complexity-Entropy Plane (BiCEP) for analyzing and ranking cryptocurrency efficiency.

Novelty

This work is novel in its application of complexity theory to cryptocurrency efficiency evaluation, distinguishing itself from previous research that primarily focuses on traditional financial assets.

Limitations

- The study does not account for external factors influencing crypto market dynamics, such as regulatory changes or macroeconomic events.

- The analysis is based on historical data and does not predict future efficiency trends.

Future Work

- Further investigation into the impact of varying block sizes and time spans on BiCEP results.

- Exploration of additional complexity measures to enhance the efficiency assessment of cryptocurrencies.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTime-series Random Process Complexity Ranking Using a Bound on Conditional Differential Entropy

Reinhard Furrer, Lothar Sebastian Krapp, Balthasar Bickel et al.

Quantifying Cryptocurrency Unpredictability: A Comprehensive Study of Complexity and Forecasting

Manuel Roveri, Fabrizio Pittorino, Francesco Puoti

No citations found for this paper.

Comments (0)