Summary

This paper identifies new currency risk stemming from a network of idiosyncratic option-based currency volatilities and shows how such network risk is priced in the cross-section of currency returns. A portfolio that buys net-receivers and sells net-transmitters of short-term linkages between currency volatilities generates a significant Sharpe ratio. The network strategy formed on causal connections is uncorrelated with popular benchmarks and generates a significant alpha, while network returns formed on aggregate connections, which are driven by a strong correlation component, are partially subsumed by standard factors. Long-term linkages are priced less, indicating a downward-sloping term structure of network risk.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

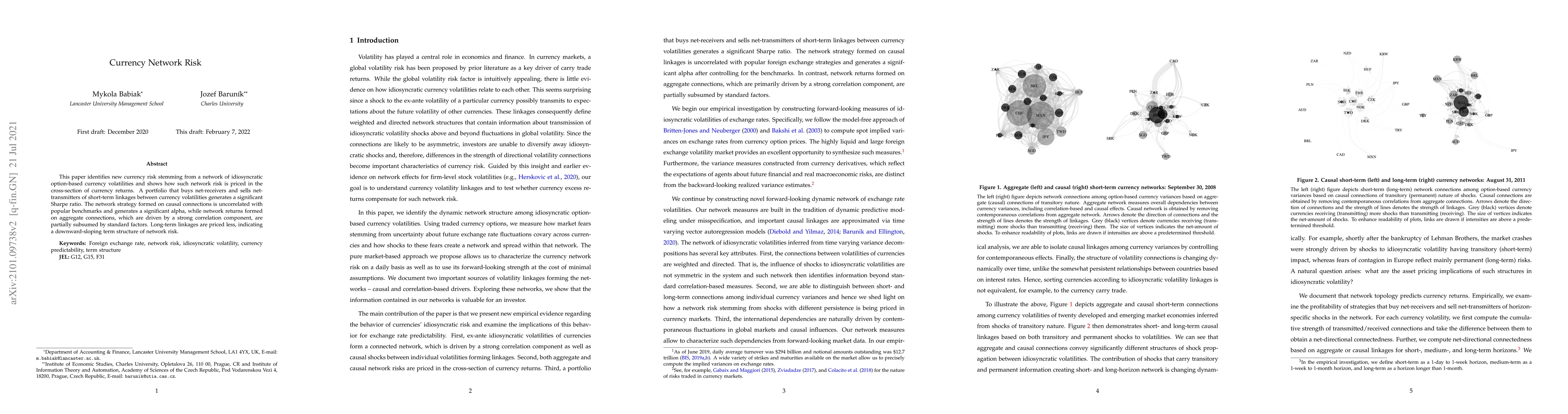

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDealing with multi-currency inventory risk in FX cash markets

Philippe Bergault, Olivier Guéant, Alexander Barzykin

No citations found for this paper.

Comments (0)