Summary

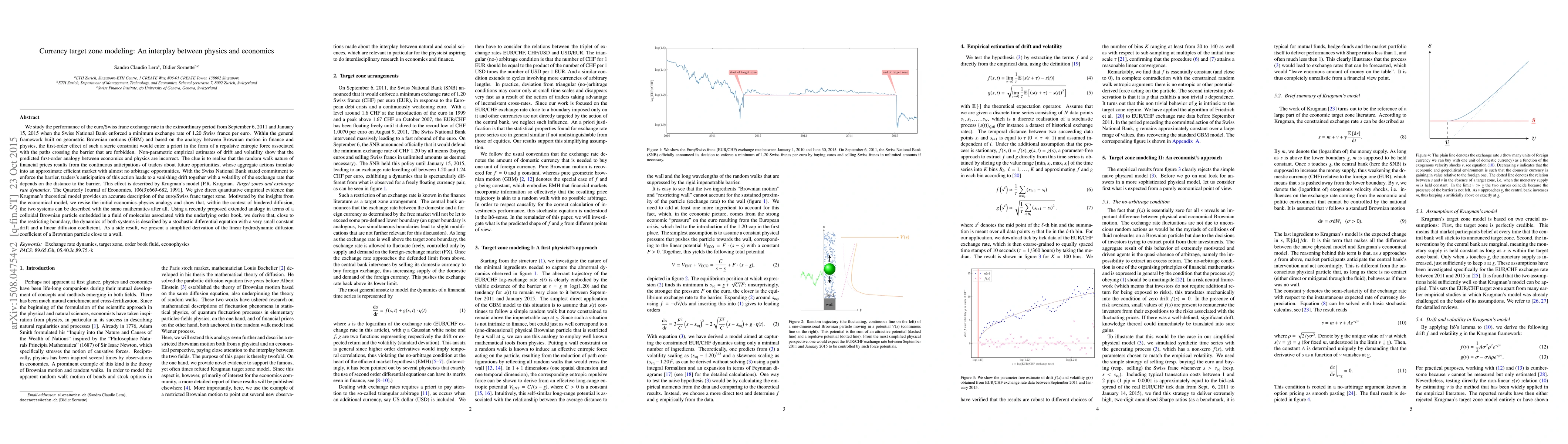

We study the performance of the euro/Swiss franc exchange rate in the extraordinary period from September 6, 2011 and January 15, 2015 when the Swiss National Bank enforced a minimum exchange rate of 1.20 Swiss francs per euro. Based on the analogy between Brownian motion in finance and physics, the first-order effect of such a steric constraint would enter a priori in the form of a repulsive entropic force associated with the paths crossing the barrier that are forbidden. Non-parametric empirical estimates of drift and volatility show that the predicted first-order analogy between economics and physics are incorrect. The clue is to realise that the random walk nature of financial prices results from the continuous anticipations of traders about future opportunities, whose aggregate actions translate into an approximate efficient market with almost no arbitrage opportunities. With the Swiss National Bank stated commitment to enforce the barrier, traders's anticipation of this action leads to a vanishing drift together with a volatility of the exchange rate that depends on the distance to the barrier. We give direct quantitative empirical evidence that this effect is well described by Krugman's target zone model [P.R. Krugman. The Quarterly Journal of Economics, 106(3):669-682, 1991]. Motivated by the insights from this economical model, we revise the initial economics-physics analogy and show that, within the context of hindered diffusion, the two systems can be described with the same mathematics after all. Using a recently proposed extended analogy in terms of a colloidal Brownian particle embedded in a fluid of molecules associated with the underlying order book, we derive that, close to the restricting boundary, the dynamics of both systems is described by a stochastic differential equation with a very small constant drift and a linear diffusion coefficient.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersModeling the interplay between epidemics and regional socio-economics

Rafael A. Barrio, Kimmo K. Kaski, Jan E. Snellman et al.

The Economics and Econometrics of Gene-Environment Interplay

Stephanie von Hinke, Hans van Kippersluis, Cornelius A. Rietveld et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)