Summary

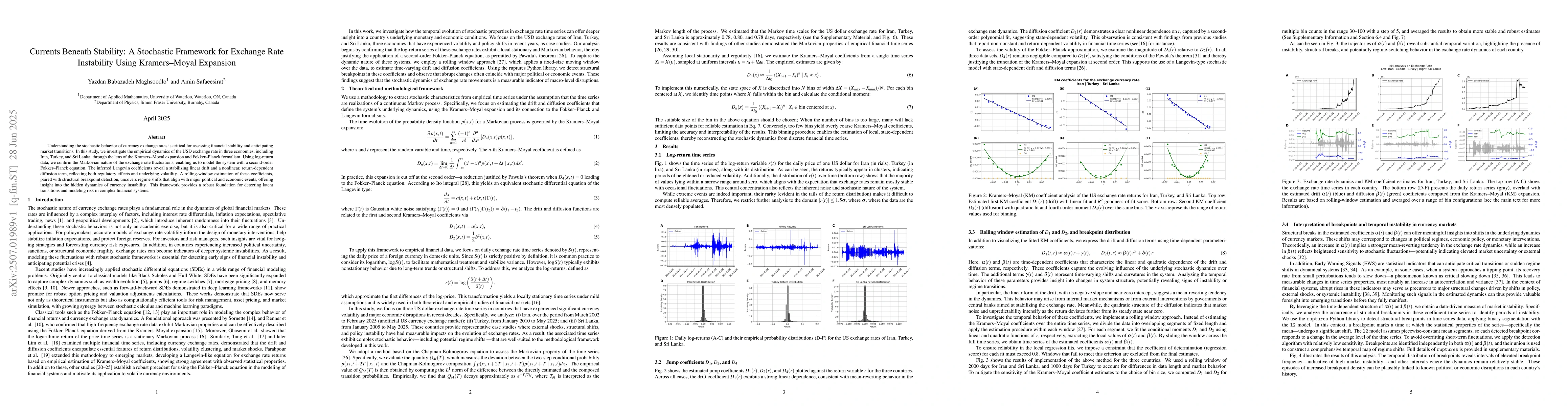

Understanding the stochastic behavior of currency exchange rates is critical for assessing financial stability and anticipating market transitions. In this study, we investigate the empirical dynamics of the USD exchange rate in three economies, including Iran, Turkey, and Sri Lanka, through the lens of the Kramers-Moyal expansion and Fokker-Planck formalism. Using log-return data, we confirm the Markovian nature of the exchange rate fluctuations, enabling us to model the system with a second-order Fokker-Planck equation. The inferred Langevin coefficients reveal a stabilizing linear drift and a nonlinear, return-dependent diffusion term, reflecting both regulatory effects and underlying volatility. A rolling-window estimation of these coefficients, paired with structural breakpoint detection, uncovers regime shifts that align with major political and economic events, offering insight into the hidden dynamics of currency instability. This framework provides a robust foundation for detecting latent transitions and modeling risk in complex financial systems.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)