Summary

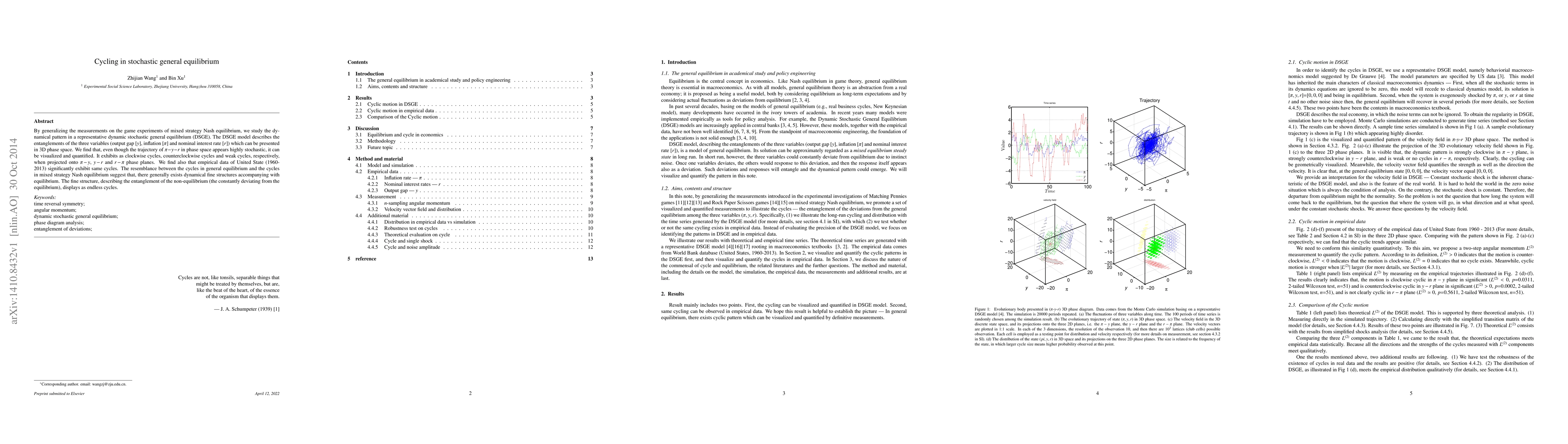

By generalizing the measurements on the game experiments of mixed strategy Nash equilibrium, we study the dynamical pattern in a representative dynamic stochastic general equilibrium (DSGE). The DSGE model describes the entanglements of the three variables (output gap [$y$], inflation [$\pi$] and nominal interest rate [$r$]) which can be presented in 3D phase space. We find that, even though the trajectory of $\pi\!-\!y\!-\!r$ in phase space appears highly stochastic, it can be visualized and quantified. It exhibits as clockwise cycles, counterclockwise cycles and weak cycles, respectively, when projected onto $\pi\!-\!y$, $y\!-\!r$ and $r\!-\!\pi$ phase planes. We find also that empirical data of United State (1960-2013) significantly exhibit same cycles. The resemblance between the cycles in general equilibrium and the cycles in mixed strategy Nash equilibrium suggest that, there generally exists dynamical fine structures accompanying with equilibrium. The fine structure, describing the entanglement of the non-equilibrium (the constantly deviating from the equilibrium), displays as endless cycles.

AI Key Findings

Generated Sep 03, 2025

Methodology

The research uses a stochastic general equilibrium (DSGE) model, extending measurements from previous work to explore cyclic patterns. Phase diagram analysis (PDA) is employed, with a focus on the L(2) measurement for identifying cyclic motions without requiring subjective judgment on center choice.

Key Results

- The trajectory in the π-y-r phase space exhibits clockwise, counterclockwise, and weak cycles when projected onto different phase planes.

- Empirical data from the US (1960-2013) significantly shows similar cycles, resembling those in mixed strategy Nash equilibrium.

- The fine structure of non-equilibrium deviations displays as endless cycles, suggesting inherent cyclic behavior in equilibrium.

Significance

This research contributes to understanding dynamical fine structures accompanying equilibrium, potentially aiding in macroeconomic engineering and deepening the comprehension of equilibrium concepts in economic science.

Technical Contribution

The paper introduces the L(2) measurement for identifying cyclic motions in DSGE models, which reports direction and amplitude of transitions simultaneously.

Novelty

The research distinguishes itself by visualizing and quantifying seemingly stochastic trajectories in DSGE models, revealing underlying cyclic patterns and their resemblance to mixed strategy Nash equilibrium cycles.

Limitations

- The study does not find a tractable micro-to-macro relationship, similar to previous experimental game findings.

- The absence of field or laboratory experiments to reconstruct cycles in general equilibrium limits the practical verification of results.

Future Work

- Conduct experiments (field or laboratory) to reconstruct cycles in general equilibrium.

- Merge dynamic equation model and stochastic model (e.g., DSGE) for quantitative phase space tracing.

- Develop a behavioral economics field to establish microfoundations for macroeconomic dynamics.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)