Summary

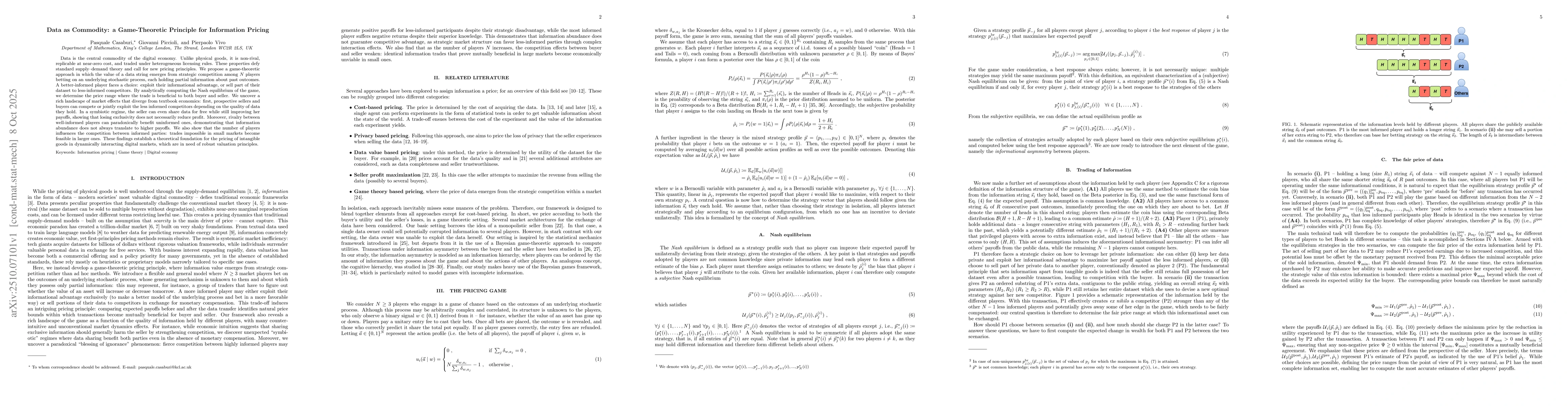

Data is the central commodity of the digital economy. Unlike physical goods, it is non-rival, replicable at near-zero cost, and traded under heterogeneous licensing rules. These properties defy standard supply--demand theory and call for new pricing principles. We propose a game-theoretic approach in which the value of a data string emerges from strategic competition among N players betting on an underlying stochastic process, each holding partial information about past outcomes. A better-informed player faces a choice: exploit their informational advantage, or sell part of their dataset to less-informed competitors. By analytically computing the Nash equilibrium of the game, we determine the price range where the trade is beneficial to both buyer and seller. We uncover a rich landscape of market effects that diverge from textbook economics: first, prospective sellers and buyers can compete or jointly exploit the less informed competitors depending on the quality of data they hold. In a symbiotic regime, the seller can even share data for free while still improving her payoffs, showing that losing exclusivity does not necessarily reduce profit. Moreover, rivalry between well-informed players can paradoxically benefit uninformed ones, demonstrating that information abundance does not always translate to higher payoffs. We also show that the number of players influences the competition between informed parties: trades impossible in small markets become feasible in larger ones. These findings establish a theoretical foundation for the pricing of intangible goods in dynamically interacting digital markets, which are in need of robust valuation principles.

AI Key Findings

Generated Oct 09, 2025

Methodology

The research employs a combination of theoretical analysis and computational simulations to study strategic decision-making under uncertainty, focusing on equilibrium strategies in game-theoretic models with volatility aversion.

Key Results

- Symmetric equilibrium strategies remain unchanged even with volatility aversion, aligning with volatility-neutral cases.

- Volatility-averse players exhibit threshold behavior, switching strategies based on belief parameters and information asymmetry.

- The seller's optimal pre-transaction strategy depends on the equilibrium strategies of less-informed players, with mixed strategies emerging under specific conditions.

Significance

This research provides critical insights into how volatility aversion affects strategic interactions in uncertain environments, offering practical implications for game theory applications in economics, finance, and decision sciences.

Technical Contribution

The work introduces a novel framework for analyzing equilibrium strategies in volatility-averse settings, combining analytical derivations with computational verification of strategic thresholds.

Novelty

This study uniquely bridges volatility aversion with strategic equilibrium analysis, demonstrating that core equilibrium strategies remain robust to risk preferences, while introducing new conditions for mixed strategy emergence.

Limitations

- The analysis assumes perfect rationality and common knowledge of payoffs, which may not hold in real-world scenarios.

- The computational complexity increases significantly with larger player groups, limiting scalability.

Future Work

- Extending the model to incorporate heterogeneous risk preferences among players.

- Investigating the impact of partial information revelation mechanisms on equilibrium strategies.

- Analyzing the role of learning dynamics in evolving volatility-averse strategies over time.

Paper Details

PDF Preview

Similar Papers

Found 4 papersPricing commodity index options

Carlos Vázquez, Andrea Pallavicini, Alberto Manzano et al.

Comments (0)