Summary

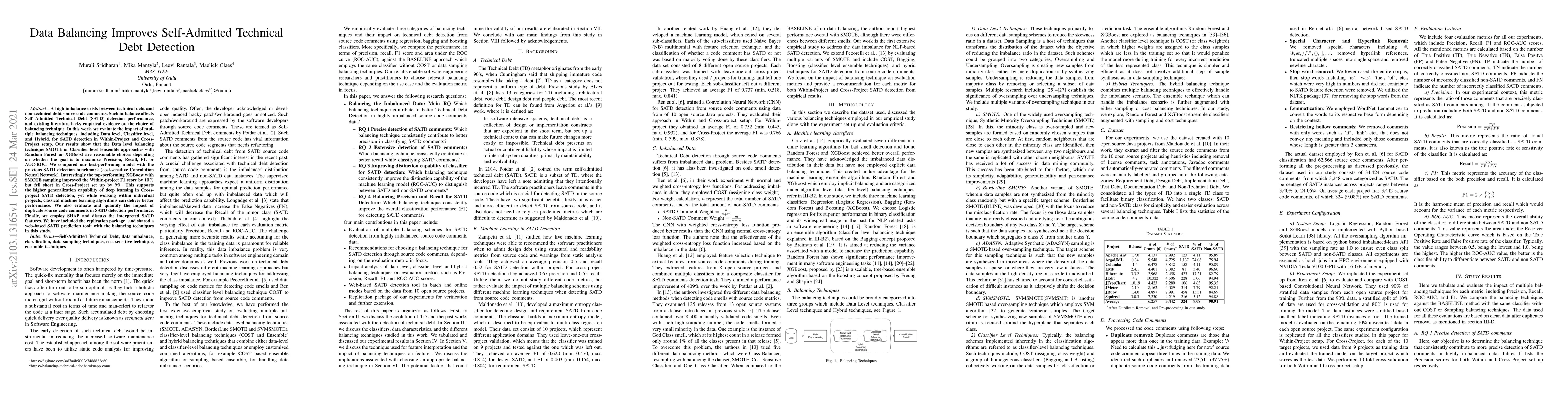

A high imbalance exists between technical debt and non-technical debt source code comments. Such imbalance affects Self-Admitted Technical Debt (SATD) detection performance, and existing literature lacks empirical evidence on the choice of balancing technique. In this work, we evaluate the impact of multiple balancing techniques, including Data level, Classifier level, and Hybrid, for SATD detection in Within-Project and Cross-Project setup. Our results show that the Data level balancing technique SMOTE or Classifier level Ensemble approaches Random Forest or XGBoost are reasonable choices depending on whether the goal is to maximize Precision, Recall, F1, or AUC-ROC. We compared our best-performing model with the previous SATD detection benchmark (cost-sensitive Convolution Neural Network). Interestingly the top-performing XGBoost with SMOTE sampling improved the Within-project F1 score by 10% but fell short in Cross-Project set up by 9%. This supports the higher generalization capability of deep learning in Cross-Project SATD detection, yet while working within individual projects, classical machine learning algorithms can deliver better performance. We also evaluate and quantify the impact of duplicate source code comments in SATD detection performance. Finally, we employ SHAP and discuss the interpreted SATD features. We have included the replication package and shared a web-based SATD prediction tool with the balancing techniques in this study.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersWeakSATD: Detecting Weak Self-admitted Technical Debt

Moritz Mock, Barbara Russo, Matteo Camilli

Exploring the Advances in Using Machine Learning to Identify Technical Debt and Self-Admitted Technical Debt

Nasir U. Eisty, Eric L. Melin

Deep Learning and Data Augmentation for Detecting Self-Admitted Technical Debt

Andrea Capiluppi, Paris Avgeriou, Edi Sutoyo

| Title | Authors | Year | Actions |

|---|

Comments (0)