Authors

Summary

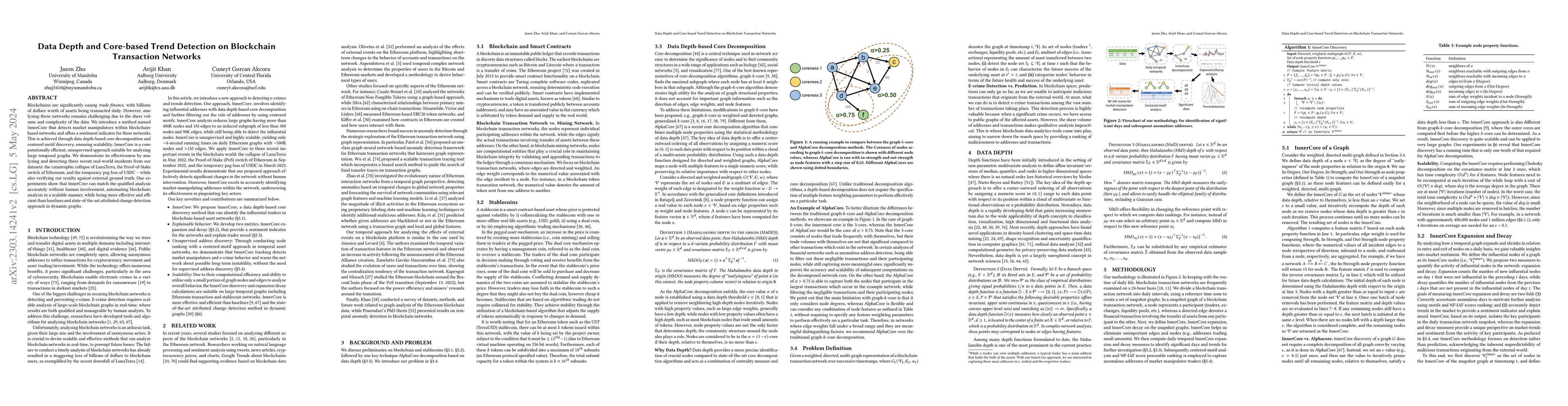

Blockchains are significantly easing trade finance, with billions of dollars worth of assets being transacted daily. However, analyzing these networks remains challenging due to the sheer volume and complexity of the data. We introduce a method named InnerCore that detects market manipulators within blockchain-based networks and offers a sentiment indicator for these networks. This is achieved through data depth-based core decomposition and centered motif discovery, ensuring scalability. InnerCore is a computationally efficient, unsupervised approach suitable for analyzing large temporal graphs. We demonstrate its effectiveness by analyzing and detecting three recent real-world incidents from our datasets: the catastrophic collapse of LunaTerra, the Proof-of-Stake switch of Ethereum, and the temporary peg loss of USDC - while also verifying our results against external ground truth. Our experiments show that InnerCore can match the qualified analysis accurately without human involvement, automating blockchain analysis in a scalable manner, while being more effective and efficient than baselines and state-of-the-art attributed change detection approach in dynamic graphs.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTRacer: Scalable Graph-based Transaction Tracing for Account-based Blockchain Trading Systems

Zibin Zheng, Jiajing Wu, Jieli Liu et al.

TIPS: Transaction Inclusion Protocol with Signaling in DAG-based Blockchain

Xu Chen, Zhixuan Fang, Canhui Chen

Quantum Feature Optimization for Enhanced Clustering of Blockchain Transaction Data

Samuel Yen-Chi Chen, Yun-Cheng Tsai

| Title | Authors | Year | Actions |

|---|

Comments (0)