Authors

Summary

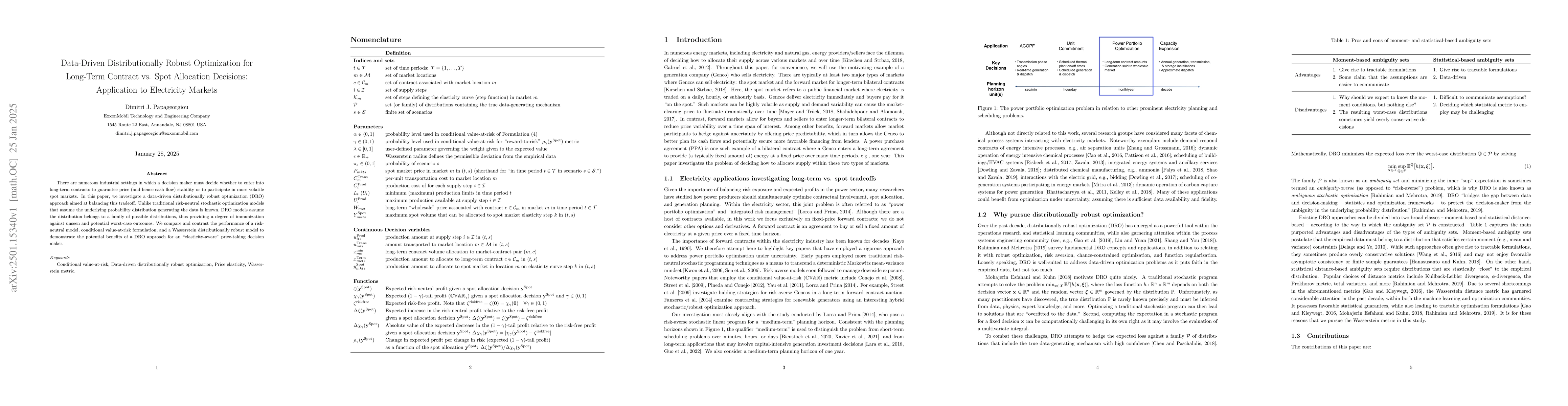

There are numerous industrial settings in which a decision maker must decide whether to enter into long-term contracts to guarantee price (and hence cash flow) stability or to participate in more volatile spot markets. In this paper, we investigate a data-driven distributionally robust optimization (DRO) approach aimed at balancing this tradeoff. Unlike traditional risk-neutral stochastic optimization models that assume the underlying probability distribution generating the data is known, DRO models assume the distribution belongs to a family of possible distributions, thus providing a degree of immunization against unseen and potential worst-case outcomes. We compare and contrast the performance of a risk-neutral model, conditional value-at-risk formulation, and a Wasserstein distributionally robust model to demonstrate the potential benefits of a DRO approach for an ``elasticity-aware'' price-taking decision maker.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersData-Driven Bayesian Nonparametric Wasserstein Distributionally Robust Optimization

Xutao Ma, Chao Ning

Moment Relaxations for Data-Driven Wasserstein Distributionally Robust Optimization

Suhan Zhong, Shixuan Zhang

| Title | Authors | Year | Actions |

|---|

Comments (0)