Authors

Summary

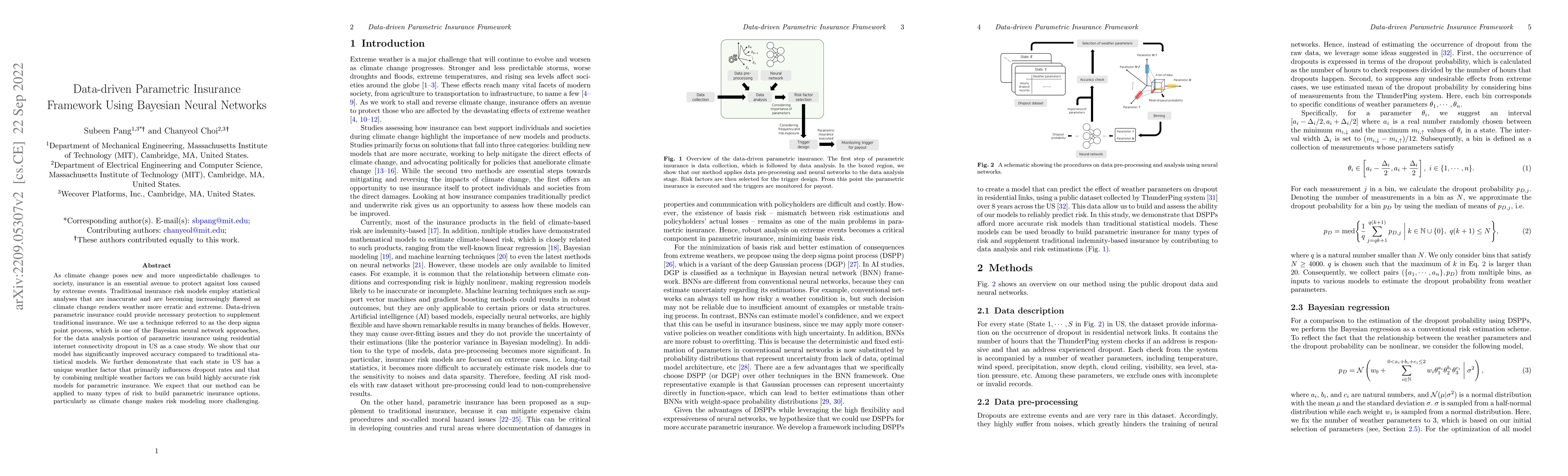

As climate change poses new and more unpredictable challenges to society, insurance is an essential avenue to protect against loss caused by extreme events. Traditional insurance risk models employ statistical analyses that are inaccurate and are becoming increasingly flawed as climate change renders weather more erratic and extreme. Data-driven parametric insurance could provide necessary protection to supplement traditional insurance. We use a technique referred to as the deep sigma point process, which is one of the Bayesian neural network approaches, for the data analysis portion of parametric insurance using residential internet connectivity dropout in US as a case study. We show that our model has significantly improved accuracy compared to traditional statistical models. We further demonstrate that each state in US has a unique weather factor that primarily influences dropout rates and that by combining multiple weather factors we can build highly accurate risk models for parametric insurance. We expect that our method can be applied to many types of risk to build parametric insurance options, particularly as climate change makes risk modeling more challenging.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersData-driven prediction of tool wear using Bayesian-regularized artificial neural networks

Panagiotis Karras, Ramin Aghababaei, Tam T. Truong et al.

A Data-Driven Probabilistic Framework for Cascading Urban Risk Analysis Using Bayesian Networks

Debasis Dwibedy, Chunduru Rohith Kumar, PHD Surya Shanmuk et al.

BSD: a Bayesian framework for parametric models of neural spectra

Johan Medrano, Peter Zeidman, Nicholas A. Alexander et al.

No citations found for this paper.

Comments (0)