Authors

Summary

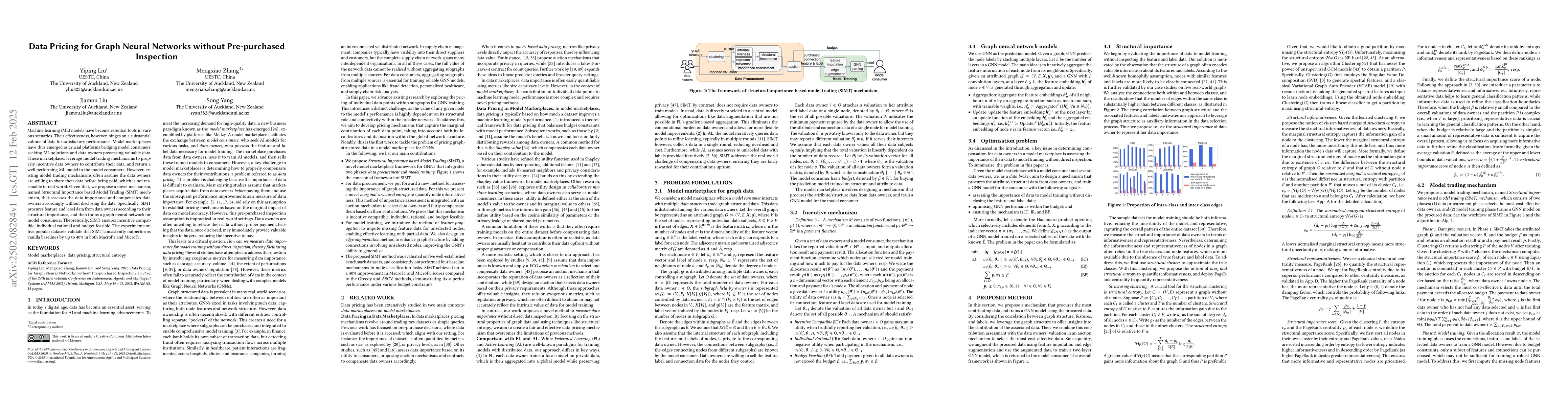

Machine learning (ML) models have become essential tools in various scenarios. Their effectiveness, however, hinges on a substantial volume of data for satisfactory performance. Model marketplaces have thus emerged as crucial platforms bridging model consumers seeking ML solutions and data owners possessing valuable data. These marketplaces leverage model trading mechanisms to properly incentive data owners to contribute their data, and return a well performing ML model to the model consumers. However, existing model trading mechanisms often assume the data owners are willing to share their data before being paid, which is not reasonable in real world. Given that, we propose a novel mechanism, named Structural Importance based Model Trading (SIMT) mechanism, that assesses the data importance and compensates data owners accordingly without disclosing the data. Specifically, SIMT procures feature and label data from data owners according to their structural importance, and then trains a graph neural network for model consumers. Theoretically, SIMT ensures incentive compatible, individual rational and budget feasible. The experiments on five popular datasets validate that SIMT consistently outperforms vanilla baselines by up to $40\%$ in both MacroF1 and MicroF1.

AI Key Findings

Generated Jun 11, 2025

Methodology

The research introduces a novel mechanism, SIMT, for data pricing in graph neural networks without pre-purchased inspection. It proposes a Structural Importance based Model Trading mechanism that assesses data importance and compensates data owners accordingly, ensuring incentive compatibility, individual rationality, and budget feasibility.

Key Results

- SIMT outperforms vanilla baselines by up to 40% in both MacroF1 and MicroF1 across five datasets.

- SIMT ensures no data disclosure while maintaining incentive properties.

- Experimental results demonstrate the effectiveness of the proposed structural importance assessment method.

- SIMT is the first model trading mechanism addressing the data disclosure problem.

- SIMT's performance is validated to be superior to baselines, showcasing the value of data selected by SIMT.

Significance

This research is significant as it tackles the challenge of incentivizing data owners to contribute their data for model training without direct inspection, ensuring privacy and efficiency in model marketplaces.

Technical Contribution

The main technical contribution is the Structural Importance based Model Trading (SIMT) mechanism, which evaluates data importance structurally and trains a GNN model on procured data, ensuring no data disclosure and maintaining incentive properties.

Novelty

SIMT is novel as it is the first model trading mechanism designed to address the data disclosure problem in graph neural networks, employing a structural importance assessment method for data valuation.

Limitations

- The study does not explore the potential privacy leakage in the trained model.

- Future work could investigate the impact of varying graph complexities on SIMT's performance.

Future Work

- Further exploration of potential privacy leakage in the trained models.

- Investigating the effect of different graph complexities on SIMT's performance.

- Examining the applicability of SIMT in other domains beyond graph neural networks.

Paper Details

PDF Preview

Similar Papers

Found 4 papersNeural Graph Matching for Pre-training Graph Neural Networks

Zhiqiang Zhang, Binbin Hu, Jun Zhou et al.

Data refinement for fully unsupervised visual inspection using pre-trained networks

Benjamin Missaoui, Antoine Cordier, Pierre Gutierrez

No citations found for this paper.

Comments (0)