Authors

Summary

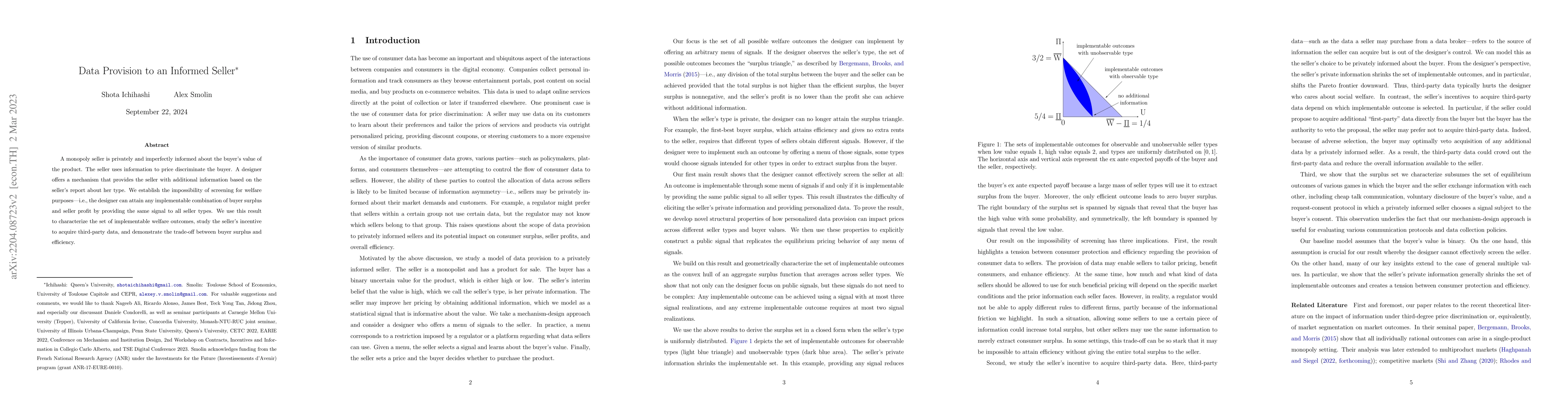

A monopoly seller is privately and imperfectly informed about the buyer's value of the product. The seller uses information to price discriminate the buyer. A designer offers a mechanism that provides the seller with additional information based on the seller's report about her type. We establish the impossibility of screening for welfare purposes, i.e., the designer can attain any implementable combination of buyer surplus and seller profit by providing the same signal to all seller types. We use this result to characterize the set of implementable welfare outcomes, study the seller's incentive to acquire third-party data, and demonstrate the trade-off between buyer surplus and efficiency.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSeller-side Outcome Fairness in Online Marketplaces

Zikun Ye, Sushant Kumar, Kaushiki Nag et al.

Leveraging Reviews: Learning to Price with Buyer and Seller Uncertainty

Kirthevasan Kandasamy, Nika Haghtalab, Ellen Vitercik et al.

No citations found for this paper.

Comments (0)