Summary

We conduct an extensive empirical study on short-term electricity price forecasting (EPF) to address the long-standing question if the optimal model structure for EPF is univariate or multivariate. We provide evidence that despite a minor edge in predictive performance overall, the multivariate modeling framework does not uniformly outperform the univariate one across all 12 considered datasets, seasons of the year or hours of the day, and at times is outperformed by the latter. This is an indication that combining advanced structures or the corresponding forecasts from both modeling approaches can bring a further improvement in forecasting accuracy. We show that this indeed can be the case, even for a simple averaging scheme involving only two models. Finally, we also analyze variable selection for the best performing high-dimensional lasso-type models, thus provide guidelines to structuring better performing forecasting model designs.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

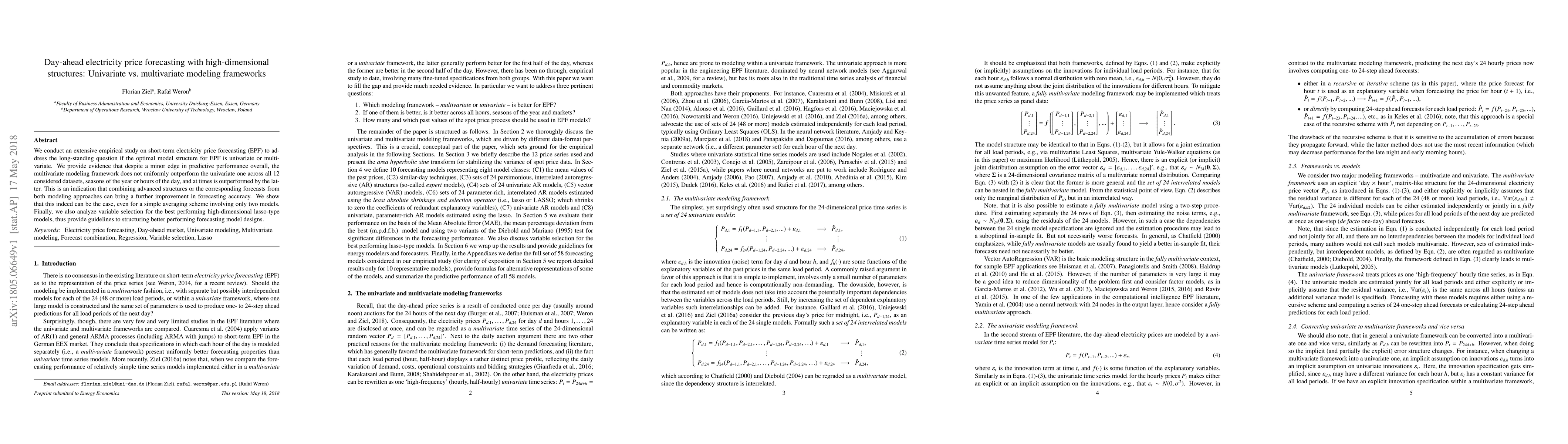

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFrom point forecasts to multivariate probabilistic forecasts: The Schaake shuffle for day-ahead electricity price forecasting

Fabian Krüger, Oliver Grothe, Fabian Kächele

| Title | Authors | Year | Actions |

|---|

Comments (0)