Authors

Summary

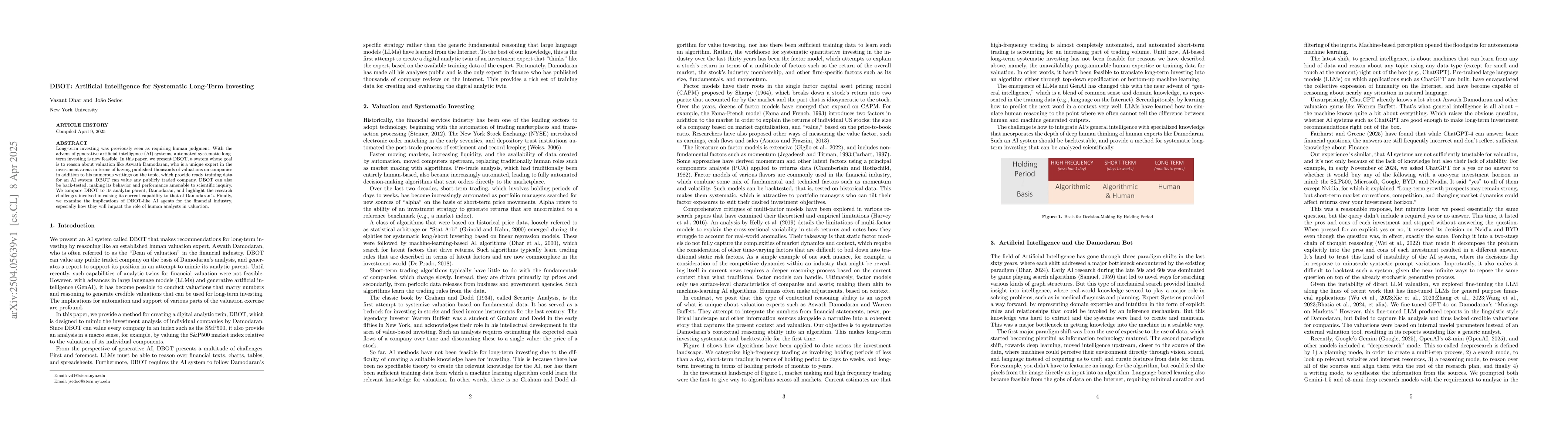

Long-term investing was previously seen as requiring human judgment. With the advent of generative artificial intelligence (AI) systems, automated systematic long-term investing is now feasible. In this paper, we present DBOT, a system whose goal is to reason about valuation like Aswath Damodaran, who is a unique expert in the investment arena in terms of having published thousands of valuations on companies in addition to his numerous writings on the topic, which provide ready training data for an AI system. DBOT can value any publicly traded company. DBOT can also be back-tested, making its behavior and performance amenable to scientific inquiry. We compare DBOT to its analytic parent, Damodaran, and highlight the research challenges involved in raising its current capability to that of Damodaran's. Finally, we examine the implications of DBOT-like AI agents for the financial industry, especially how they will impact the role of human analysts in valuation.

AI Key Findings

Generated Jun 10, 2025

Methodology

The research introduces DBOT, an AI system designed to perform systematic long-term investing by valuing publicly traded companies, using Aswath Damodaran's valuation methodologies as a benchmark. DBOT's capabilities are back-tested for scientific inquiry and compared to Damodaran's analysis.

Key Results

- DBOT can value any publicly traded company, showcasing its ability to replicate human-like valuation tasks.

- DBOT's valuation for BYD falls within a sensitivity analysis range of $417 to $468 per share, with its specific valuation at $420.

- DBOT's performance is comparable to Damodaran's, though it lacks consciousness and subjective understanding like humans.

- DBOT's machine-generated reports are often indistinguishable from those created by professional human analysts.

- DBOT has the potential to replace junior analysts or augment their work by handling heavy cognitive tasks.

Significance

This research signifies a paradigm shift in finance, enabling automated systematic long-term investing through AI. It has implications for analysts, investors, and regulators, potentially democratizing long-term investing and challenging traditional roles in the financial industry.

Technical Contribution

The paper presents DBOT, an AI system that can value companies using a methodology inspired by Aswath Damodaran's valuation techniques, demonstrating the feasibility of automated systematic long-term investing.

Novelty

DBOT represents a novel application of generative AI in the finance sector, bridging the gap between human expertise and machine learning to perform complex valuation tasks in a scientifically testable manner.

Limitations

- DBOT currently lacks the ability to generate framing questions autonomously, unlike human analysts who draw on extensive experience and implicit knowledge.

- DBOT's reliance on historical data and lack of consciousness may limit its ability to account for unforeseen events or nuanced market dynamics.

Future Work

- Further development could focus on enhancing DBOT's ability to formulate insightful framing questions, similar to human 'superforecasters'.

- Improvements in long context understanding and fine-tuning for financial abilities in LLMs could enhance DBOT's subagents' performance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)