Authors

Summary

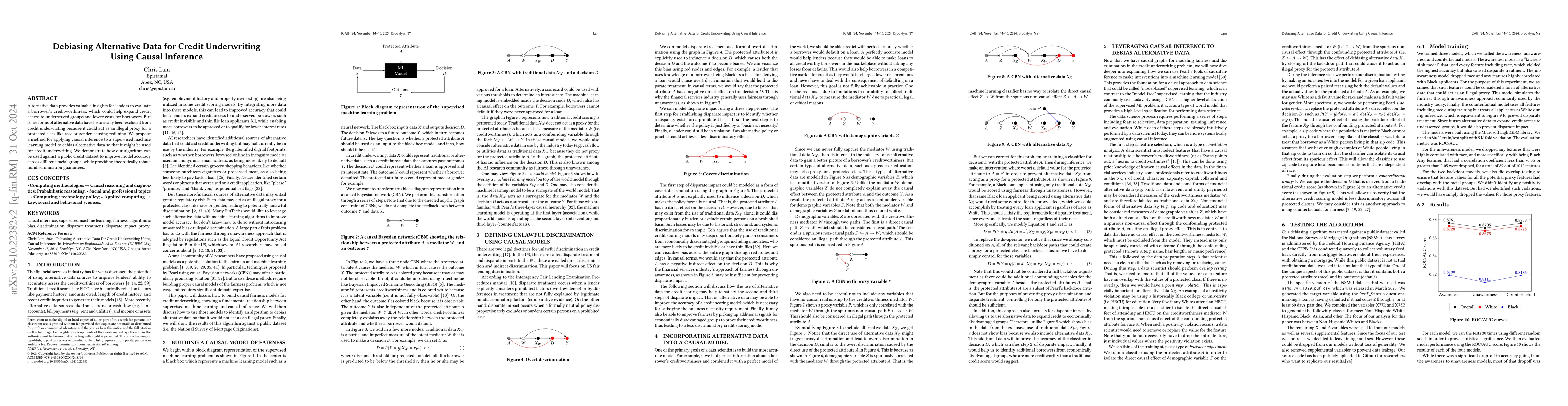

Alternative data provides valuable insights for lenders to evaluate a borrower's creditworthiness, which could help expand credit access to underserved groups and lower costs for borrowers. But some forms of alternative data have historically been excluded from credit underwriting because it could act as an illegal proxy for a protected class like race or gender, causing redlining. We propose a method for applying causal inference to a supervised machine learning model to debias alternative data so that it might be used for credit underwriting. We demonstrate how our algorithm can be used against a public credit dataset to improve model accuracy across different racial groups, while providing theoretically robust nondiscrimination guarantees.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersReinforcement Learning in Credit Scoring and Underwriting

Zheng Wen, Seksan Kiatsupaibul, Pakawan Chansiripas et al.

DINER: Debiasing Aspect-based Sentiment Analysis with Multi-variable Causal Inference

Jialong Wu, Deyu Zhou, Linhai Zhang et al.

Research on Personal Credit Risk Assessment Methods Based on Causal Inference

Jiaxin Wang, YiLong Ma

No citations found for this paper.

Comments (0)